By Louis ‘Barok’ C. Biraogo

The Philippine economy has been a tale of resilience and potential, often overshadowed by its more robust Southeast Asian neighbors. However, a recent surge in foreign direct investments (FDI) paints a promising picture for the archipelago. For the third consecutive month in March, FDI has not only risen but surged by a remarkable 23.1 percent, reaching $686 million. This marks a significant stride from the $557 million recorded in the same month last year. The cumulative net inflows for the first quarter of the year now stand at an impressive $3 billion, up by 42 percent from the previous year.

What fuels this burgeoning confidence in the Philippine market? The Bangko Sentral ng Pilipinas (BSP) attributes this growth to the country’s robust economic prospects and a welcome trend of moderating inflation. The Philippines is now one of the fastest-growing economies in the Association of Southeast Asian Nations (ASEAN), a distinction that does not come lightly.

Rizal Commercial Banking Corp.’s chief economist Michael Ricafort highlights several factors contributing to this optimistic outlook. Improved economic and financial market performance, favorable demographics, and eased long-term interest rates have collectively bolstered investor confidence. The convergence of these elements creates a fertile ground for foreign investments, further solidified by lower borrowing costs globally.

A closer examination of the investment patterns reveals intriguing insights. Nonresidents’ net investments in debt instruments rose by 19 percent year-on-year to $465 million. Simultaneously, equity capital investments, excluding reinvestment of earnings, soared by an astonishing 67.1 percent to $157 million. However, not all indicators were positive; the reinvestment of earnings from foreign firms saw a decline of 11.3 percent, signaling potential areas of concern.

Interestingly, Japan emerges as a major player in this investment narrative, contributing 64 percent of the equity capital placements in March. Singapore and the United States follow, further diversifying the investment portfolio. The Netherlands and Japan dominated the quarterly investments, steering significant capital into manufacturing, financial and insurance, and real estate sectors.

Manufacturing received the lion’s share of investments in March, capturing 66 percent, while financial and insurance services garnered 14 percent, and real estate secured 11 percent. Over the first quarter, the financial and insurance sector dominated, attracting 71 percent of investments. These sectors are pivotal in driving economic development, job creation, and technological advancement.

The implications of this FDI surge are profound. For one, the influx of foreign capital can spur job creation, reduce poverty levels, and enhance infrastructure development. The manufacturing sector, in particular, stands to benefit immensely, potentially transforming the Philippines into a significant player in the global supply chain.

Moreover, the financial and insurance sectors’ growth can bolster the country’s financial stability and resilience, ensuring a more robust economic framework. Real estate investments, albeit smaller, promise urban development and improved living standards.

Yet, there are cautionary tales within this optimistic outlook. The decline in reinvestment of earnings signals a potential lack of confidence among existing foreign businesses in the long-term viability of their Philippine operations. Addressing this requires a strategic approach to improve business conditions, reduce bureaucratic hurdles, and enhance political stability.

To sustain this upward trajectory, the Philippines must leverage this momentum by implementing policies that foster a conducive environment for both existing and new investors. Streamlining regulatory frameworks, enhancing infrastructure, and ensuring political stability are imperative. Furthermore, investing in human capital through education and skills development will ensure that the workforce can meet the demands of an evolving economic landscape.

In conclusion, the rise in FDI heralds a new chapter in the Philippine economic story, one filled with promise and potential. By capitalizing on this growth and addressing underlying challenges, the Philippines can chart a path towards sustained prosperity, positioning itself as a beacon of economic resilience and dynamism in Southeast Asia. The stakes are high, but with strategic foresight and unwavering commitment, the future indeed looks bright for the Pearl of the Orient Seas.

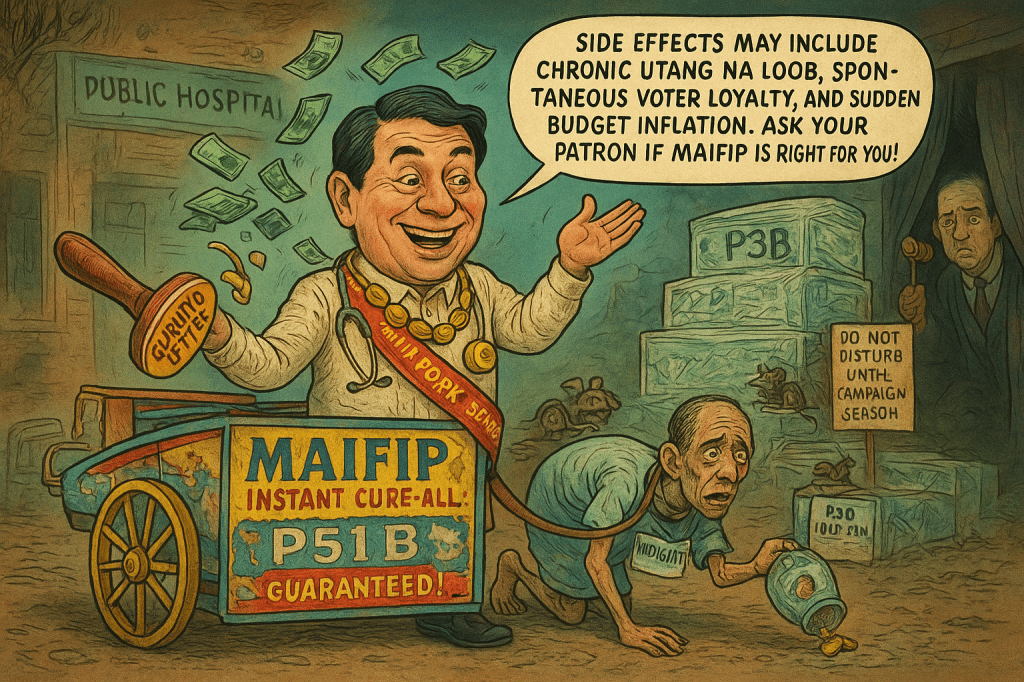

- Healthcare as Vote-Buying: The Guarantee Letter – Your Free Ticket to Utang na Loob

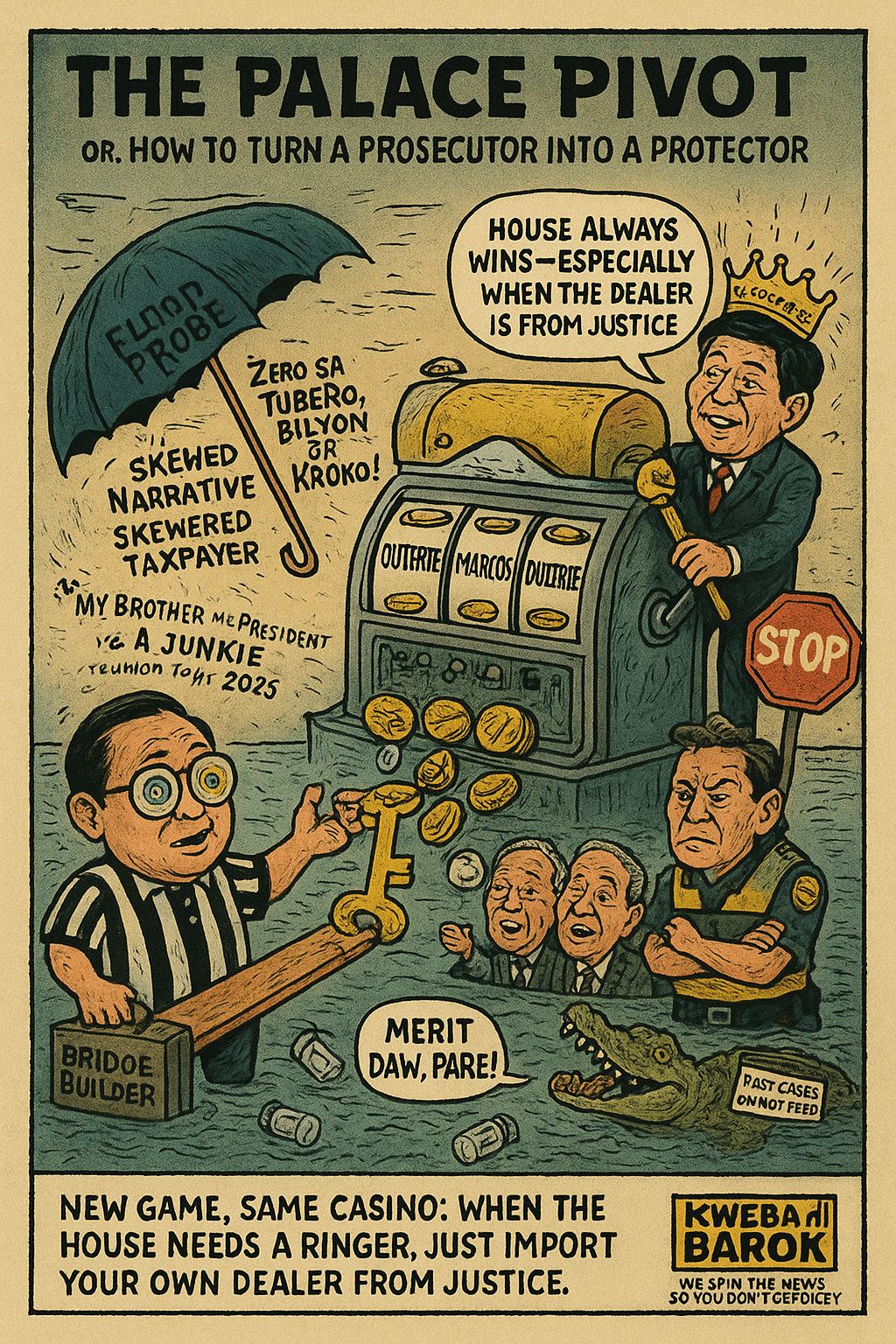

- Herbert Bautista’s Twilight Treasury Raid: Acquitted in the Sandiganbayan’s Midnight Farce

- Andres’ Palace Pivot: Fortifying Marcos’ Legal Frontline Amid Factional Storms

- Fishing Expedition or Feeding Frenzy? Sara Calls It Harassment—But the Receipts Are Still Hiding in the Deep

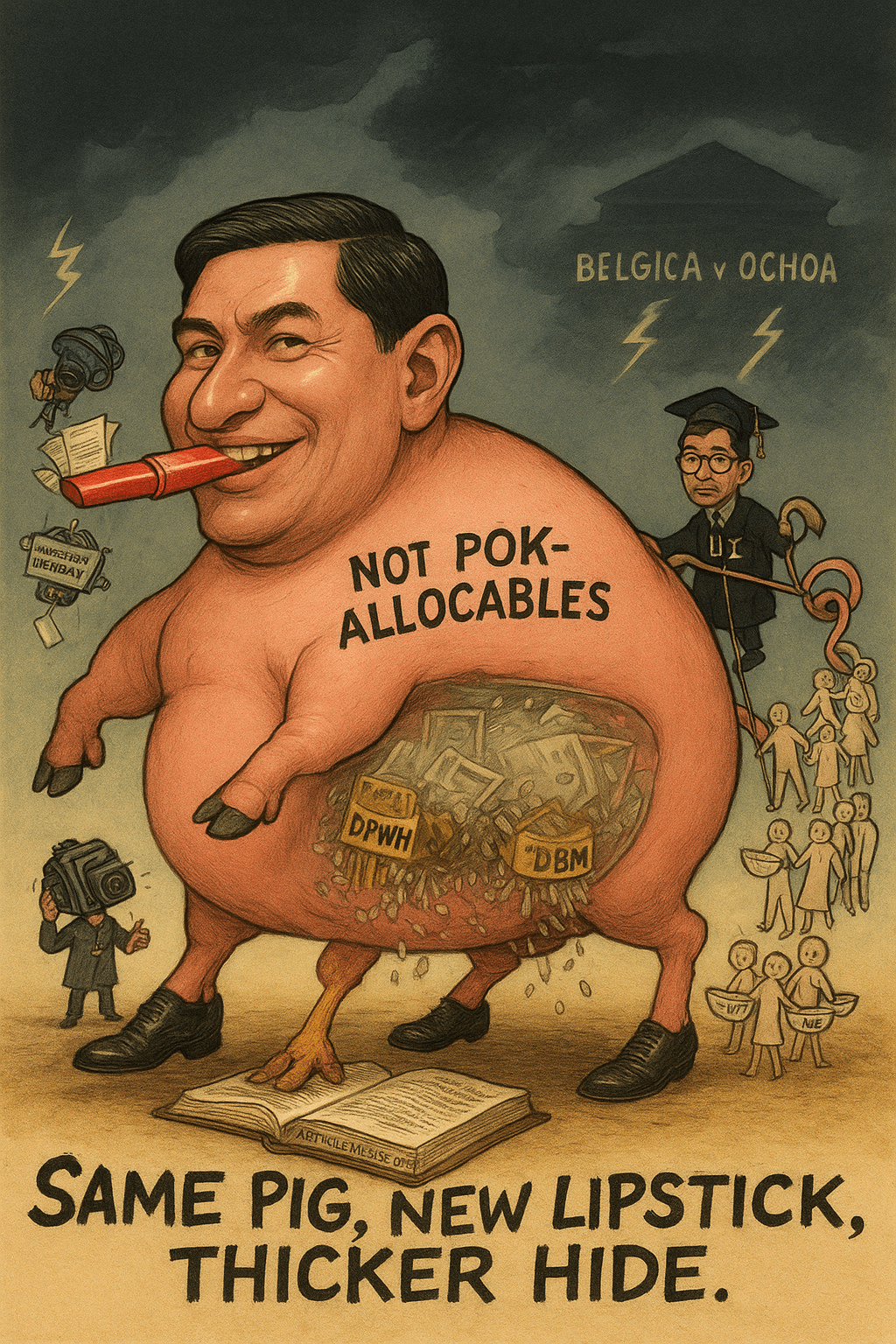

- “Allocables”: The New Face of Pork, Thicker Than a Politician’s Hide

Leave a comment