By Louis ‘Barok’ C. Biraogo

In the silent kitchens of the Philippines, as mothers pour sugary drinks into their children’s glasses, a quiet health crisis brews. The Philippine government, with noble intentions, implemented a sugar-sweetened beverage (SSB) tax in 2018, aimed at curbing the nation’s growing obesity epidemic. Yet, six years later, the initial impact of this tax has faded like the fizz from a forgotten soda. Despite a 13 to 26 percent increase in beverage prices, the consumption of SSBs remains robust. This calls for an urgent reassessment of our approach to these liquid sugar bombs.

Consider the evidence: the sales volume of sugary drinks has posted appreciable annual increases even amidst the pandemic. The Congressional Policy and Budget Research Department (CPBRD) warns that the current SSB tax is neither discouraging consumption nor optimizing potential tax collections. Rising incomes allow households to absorb nominal price increases, rendering the tax ineffective.

The science is irrefutable. Excessive consumption of sugar, particularly in liquid form, is a silent killer. It’s a well-documented fact that processed sugars and high-fructose corn syrup contribute significantly to the prevalence of obesity, diabetes, and cardiovascular diseases. Studies have shown that high-fructose corn syrup, commonly found in many SSBs, is metabolized by the liver into fat, leading to fatty liver disease, insulin resistance, and increased fat deposition around the organs.

Refined sugar, devoid of any nutritional value, spikes blood glucose levels and leads to a subsequent crash, fostering a cycle of overeating and addiction. Research published in journals such as “The Lancet” and “JAMA” has consistently shown the direct correlation between high sugar intake and the rise of metabolic disorders. These health hazards extend beyond physical ailments, impacting mental health and cognitive function, particularly in children who are the most frequent consumers of these beverages.

The evidence demands action. CPBRD’s proposal to adjust the tax rates is not just a fiscal strategy but a moral imperative. By modifying the SSB tax to account for inflation, or by shifting to an ad valorem tax which adjusts with price increases, we can restore the tax’s effectiveness. This could potentially yield as much as P42.32 billion next year, a substantial increase from the P30.71 billion estimated under the current regime.

But this is not just about revenue. An enhanced SSB tax can steer consumer behavior towards healthier choices. This is crucial in a country where the prevalence of lifestyle-related diseases is alarmingly high. Higher taxes on SSBs can deter their consumption, particularly among price-sensitive populations, encouraging them to opt for healthier, more affordable alternatives like water or natural juices.

Finance Secretary Ralph Recto’s reluctance to push for higher taxes on SSBs overlooks the broader public health crisis at stake. It is time for the government to act decisively. By recalibrating the SSB tax, we can strike a blow against the tide of preventable diseases that threaten to overwhelm our healthcare system.

In conclusion, the SSB tax needs an urgent upgrade to reflect current economic realities and public health needs. This is not just a matter of economic policy but a battle for the health of the nation. Let us not allow another generation to be sacrificed at the altar of corporate profit and consumer indulgence. The time to act is now. The health of our children, our communities, and our nation depends on it.

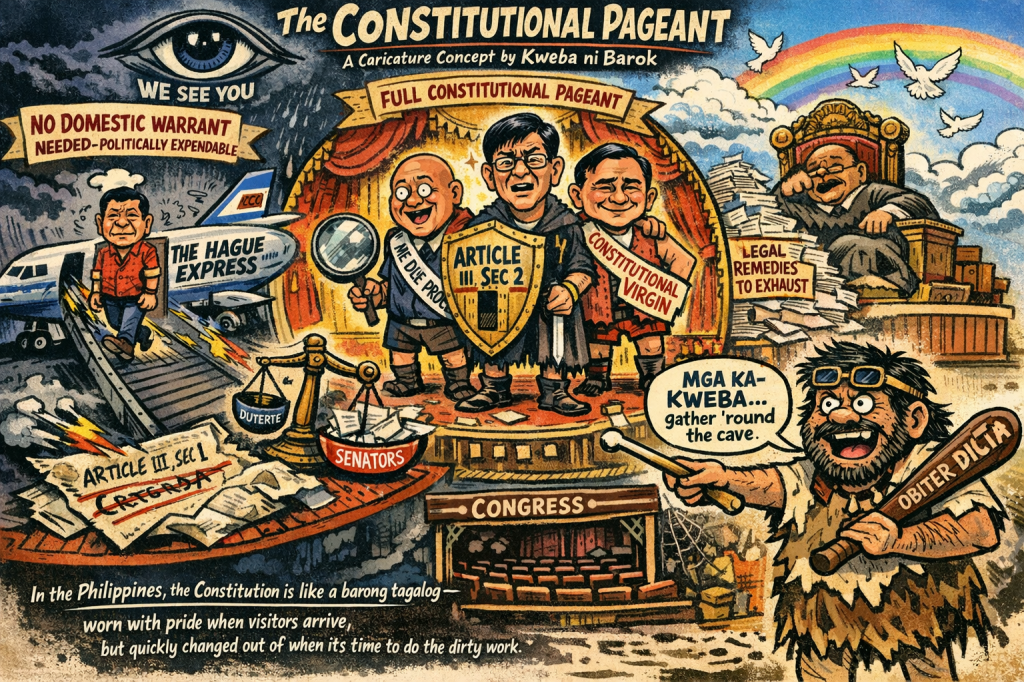

- Why Duterte Got the Fast-Track to The Hague but Bato & Bong Go Deserve a Full Constitutional Pageant

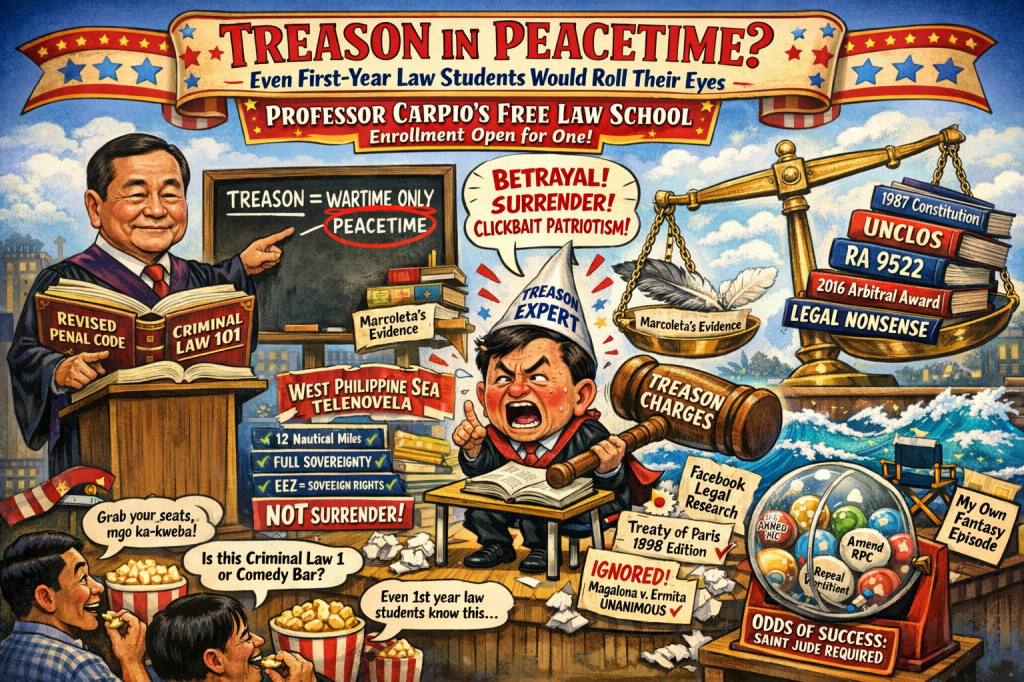

- Marcoleta’s Treason Fantasy: Why Charging Carpio for Peacetime “Betrayal” Is the Dumbest Thing You’ll Read This Week

- DOJ Caught Shielding Alleged Rapist Because He’s Their Sabungeros Golden Boy? The Ugly Truth Exposed

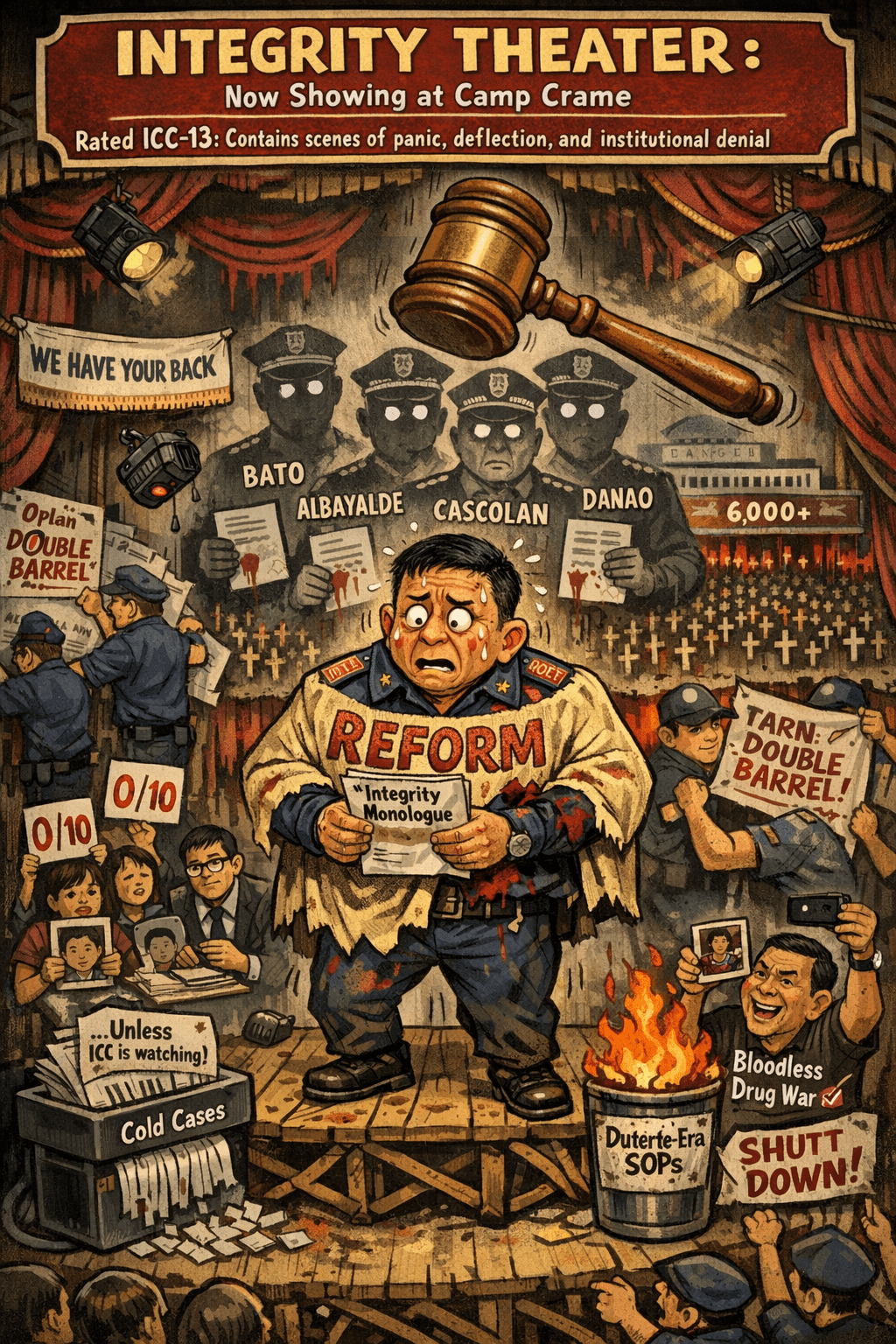

- PNP “Integrity Reforms”: Nartatez’s ICC Panic Button or Just Another Camp Crame Comedy Special?

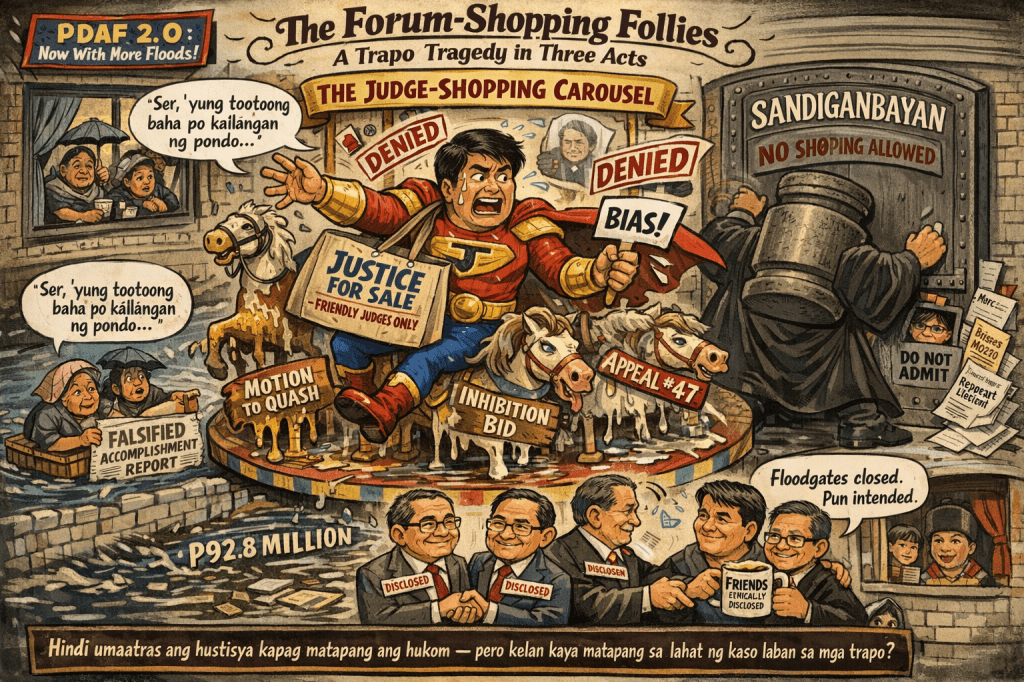

- Revilla’s Desperate Judge-Shopping Fails: Sandiganbayan Slams the Door on Inhibition Bid

Leave a comment