By Louis ‘Barok’ C Biraogo — February 24, 2025

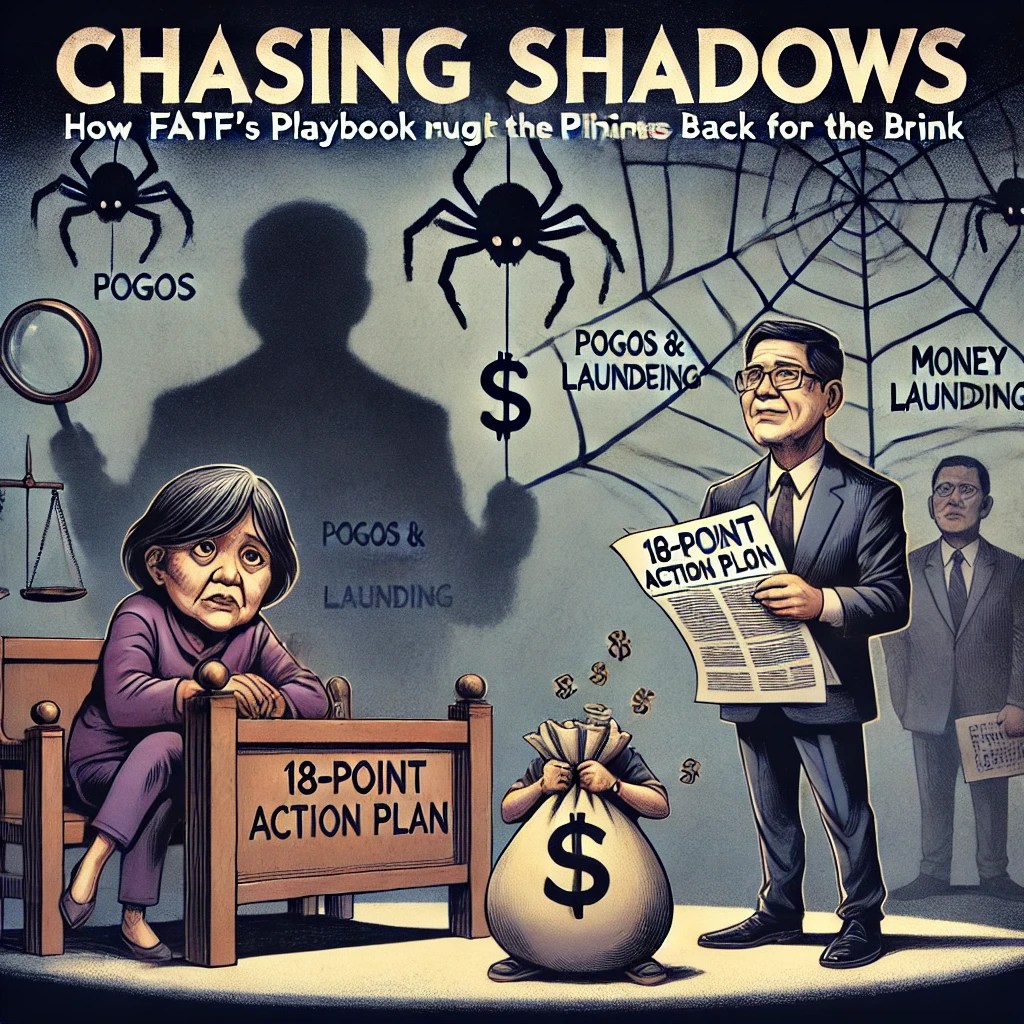

MARIA Santos sat in silence, her hands trembling as prosecutors painted a chilling picture of betrayal and greed. Her late husband’s name had become a footnote in a sprawling web of corruption—money funneled from his tiny sari-sari store to shadowy offshore accounts in Singapore. He wasn’t just another victim; he was a pawn in a deadly game involving human trafficking and money laundering tied to Philippine offshore gaming operations (POGOs). His murder left Maria widowed and her family shattered. But this wasn’t just personal—it was national. The Philippines’ place on the Financial Action Task Force (FATF) grey list since 2021 underscored how deeply entrenched these crimes were in the country’s financial system.

This month, that narrative shifted. On February 21, 2025, the FATF removed the Philippines from its grey list, a victory that Justice Secretary Jesus Crispin Remulla called “a major achievement in our fight against money laundering and terrorism financing.” The delisting didn’t come easily—it was the culmination of a grueling four-year journey, an 18-point action plan, and a relentless push by Remulla to transform a creaky system into a bulwark against financial crime. But as the champagne pops in Malacañang, the question lingers: Can this hard-won progress endure? And what does it mean for the millions like Maria, caught in the crosshairs of a global battle for financial integrity?

A Long Road to Redemption

The Philippines’ grey-list saga began in 2021, when the FATF flagged deficiencies ranging from lax oversight of casino junkets to sluggish terrorism financing prosecutions. For a country once blacklisted in 2000—joining pariahs like North Korea and Iran—the designation was a stinging reminder of past failures. Back then, Asia’s second-most populous nation had virtually no anti-money laundering framework. The 2003 Anti-Money Laundering Act pulled it off the blacklist, but gaps persisted, especially in the casino sector and POGOs, which ballooned into hubs for financial crime under weak regulation.

Enter the 18-point action plan—a roadmap to redemption that demanded everything from tighter supervision of non-financial businesses to cross-border currency controls. By October 2024, the FATF signaled hope, noting the plan was “substantially completed.” An on-site visit loomed as the final test, and this month, the verdict arrived: the Philippines had clawed its way out. Executive Secretary Lucas Bersamin hailed it as “a testament to the hard work and coordination across government agencies,” projecting a boost in foreign investment and smoother banking ties.

At the helm of this turnaround was Remulla, a former congressman turned justice secretary under President Ferdinand Marcos Jr. His leadership wasn’t flashy—it was methodical, leaning on task forces and interagency grit. Yet the stakes were sky-high: failure risked a slide back to the blacklist, choking remittances from 10 million overseas Filipino workers and spooking investors already wary of regional instability.

Cracking the Case: Reform in Action

The delisting wasn’t just bureaucratic box-checking—it was built on tangible wins. Take the Task Force on Anti-Money Laundering, led by Deputy State Prosecutor Deana Perez. Last year, her team dismantled a syndicate laundering $50 million through fake charities, a case that netted 12 convictions—a rarity in a system once paralyzed by backlogs. “We had to prove we could hit hard and fast,” Perez told me, her voice steady but weary. “Every case was a message to the FATF: we’re serious.”

Training was key. Since 2022, over 500 prosecutors have completed specialized courses on financial crime, many funded by international partners like the U.S. and Australia. Technology followed suit—the Anti-Money Laundering Council (AMLC) rolled out real-time transaction monitoring systems, cutting detection times from weeks to hours. Coordination sharpened too: the Philippine National Police, National Bureau of Investigation, and AMLC now share a unified database, a leap from the siloed past.

International cooperation proved decisive. A joint operation with Interpol last fall froze $20 million in assets linked to a terrorism financing ring, showcasing Manila’s newfound clout. “We’re not just following orders—we’re setting the pace,” Senior Assistant State Prosecutor Rex Guingoyon said, crediting Remulla’s push to align with global standards.

A Cleaner System, A Brighter Future?

The payoff is already visible. The AMLC estimates that delisting could slash cross-border transaction costs by 15%, a boon for the $34 billion remittance economy. Banks, once skittish about compliance risks, are warming up—Citibank recently hinted at expanding its Manila operations. Foreign direct investment, which dipped to $9.2 billion in 2023 amid grey-list woes, could rebound past $12 billion by 2026, economists predict. “This isn’t just about numbers,” says Maria Elena Cruz, a small-business owner in Quezon City. “It’s about trust. I can export my goods without endless red tape now.”

Yet the balance is delicate. Enforcement must coexist with facilitation—overzealous crackdowns could stifle legitimate business. The POGO ban, enacted by Marcos in 2024, slashed a $2 billion industry but left 40,000 workers jobless, sparking debate over collateral damage. “We cleaned house, but we can’t stop there,” cautions Bangko Sentral ng Pilipinas Governor Eli Remolona. “Sustainability is the real test.”

Regionally, the Philippines’ success reverberates. ASEAN neighbors like Indonesia and Thailand, also battling financial crime, are watching closely. “If we can lead, we can lift the whole region,” Remulla told a recent summit in Singapore, positioning Manila as a compliance beacon in a turbulent Southeast Asia.

Remulla’s Quiet Revolution

Remulla’s imprint is undeniable. His strategic vision—zeroing in on financial crimes as a national security issue—galvanized a sprawling bureaucracy. He restructured the DOJ’s Law Enforcement Cluster, empowering prosecutors like Perez and Guingoyon with resources and autonomy. Capacity building became his mantra: he lobbied for a 20% budget hike for the National Prosecution Service in 2024, winning over skeptics in Congress.

Internationally, he’s earned credibility. FATF President Elisa de Anda Madrazo praised his “unwavering commitment” during a February plenary. At home, he’s less flamboyant than past leaders, preferring closed-door strategy sessions to press conferences. “He’s not here for applause—he’s here for results,” says DOJ Undersecretary Jesse Andres, who credits Remulla with uniting agencies once at odds.

Challenges loom, though. Corruption scandals, like the 2023 bribery probe of customs officials, test his reforms’ resilience. And with POGOs gone, new fronts—cybercrime syndicates, for one—threaten to fill the void.

Looking Ahead: Sustaining the Win

The Philippines stands at a crossroads. Delisting is a triumph, but it’s not a cure-all. To maintain momentum, Remulla must double down on institutional strength—more funding for prosecutors, not less. Modernizing monitoring systems, like blockchain-based tracking, could keep pace with digital threats. International ties need deepening—joint task forces with Japan and the EU could lock in gains.

Human capital is the linchpin. “We need a generation of investigators who think like detectives, not clerks,” Perez says, pushing for advanced training hubs. For Maria Santos, justice remains incomplete—her husband’s killers are behind bars, but the system that enabled them lingers in memory. “I want my son to grow up in a country that fights for him,” she says, her voice breaking.

Globally, this is more than a Philippine story. It’s a test of whether emerging democracies can tame financial chaos without sacrificing growth. It’s a lesson in how leadership, when steady and systemic, can rewrite a nation’s fate. Remulla’s not done—he can’t be. The widow in Manila, the investor in New York, and the regulator in Paris are all watching. The tension hasn’t eased; it’s just shifted. And that’s the point: in the fight for integrity, the work never stops.

- “Forthwith” to Farce: How the Senate is Killing Impeachment—And Why Enrile’s Right (Even If You Can’t Trust Him)

- “HINDI AKO NAG-RESIGN!”

- “I’m calling you from my new Globe SIM. Send load!”

- “Mahiya Naman Kayo!” Marcos’ Anti-Corruption Vow Faces a Flood of Doubt

- “Meow, I’m calling you from my new Globe SIM!”

- “PLUNDER IS OVERRATED”? TRY AGAIN — IT’S A CALCULATED KILL SHOT

- “Several Lifetimes,” Said Fajardo — Translation: “I’m Not Spending Even One More Day on This Circus”

- “Shimenet”: The Term That Broke the Internet and the Budget

- “We Did Not Yield”: Marcos’s Stand and the Soul of Filipino Sovereignty

- “We Gather Light to Scatter”: A Tribute to Edgardo Bautista Espiritu

- $150M for Kaufman to Spin a Sinking Narrative

- $2 Trillion by 2050? Manila’s Economic Fantasy Flimsier Than a Taho Cup

Leave a comment