By Louis ‘Barok‘ C. Biraogo — April 27, 2025

IN Manila’s shadow, Maria, a rice farmer from Nueva Ecija, eyes a new highway carved by bulldozers under a public-private partnership (PPP). It’s part of the Philippines’ “Build Better More” blitz, promising to link her fields to markets. But as the nation’s debt skyrockets to P16.4 trillion in 2024—$284 billion, with P2.1 billion in daily interest payments—Maria wonders: Will this road deliver prosperity, or will it pave a path to fiscal ruin for her children?

The Philippines, crowned a top-three growth titan in 2023 and 2024, is a high-stakes gamble, blending dazzling promise with ominous peril. Let’s dissect this paradox with a critical eye.

Rocket Fuel or Fool’s Gold? Unpacking the Growth Hype

The Philippines’ GDP growth—5.6% in 2023 and 5.6% in 2024—is a blazing streak, outpacing China (5.2% in 2023) and Indonesia (5.0% in 2024), landing third globally behind India (9.2% in 2023, 6.5% in 2024) and Vietnam (7.1% in 2024). Among ASEAN-6, only Vietnam’s export-driven engine runs hotter. The Philippines, fueled by remittances and a services sector buzzing with business process outsourcing (BPO) and tourism, boasts a PPP GDP of $1.37 trillion, ranking 31st globally—behind Indonesia’s $4.66 trillion but ahead of Singapore’s $910 billion.

But is this growth a rising tide or a mirage? The Gini index dipped below high-inequality levels in 2023, and poverty fell from 16.7% in 2018 to 15.5% in 2023, yet rural-urban divides persist. Maria’s reality—tied to agriculture, which shrank 1.6% in 2024 due to typhoons—shows infrastructure and BPO jobs clustering in cities, leaving farmers adrift. Sustainability is shakier still: the Philippines ranks 169th out of 180 in the 2024 Environmental Performance Index, with marine pollution and climate risks threatening its “blue economy” dreams.

Globally, the Philippines mirrors BRICS’ vigor—China, India, Russia averaging 5.5%, 8.2%, 3.2% from 2021–2024—while the G7 (U.S., Japan, Germany at 3.6%, 1.3%, 1.1%) sputters. Its young workforce and urbanization echo India’s demographic edge, but unlike Vietnam’s manufacturing muscle, the Philippines’ service-led model leans heavily on remittances (10% of GDP) and volatile tourism. Structural cracks—high debt, a $52 billion trade deficit in 2023, and agricultural fragility—could crumble under global shocks, like looming U.S. tariffs.

The Dark Side of the Boom: A Debt Volcano and Shaky Foundations

The Philippines’ public debt, exploding 99% from P8.22 trillion in 2019 to P16.4 trillion in 2024, casts a long shadow. At 60.7% of GDP, it teeters above the 60% international red line, with interest payments gobbling P763 billion annually—enough to fund healthcare for millions. Finance Secretary Ralph Recto calls it “manageable,” eyeing growth to outpace borrowing by 2028, with GDP projected at P37 trillion against P20 trillion in debt. But taxpayers like Maria, pinched by 3.2% inflation in 2024, face a future where debt servicing starves social programs. The Institute of International Finance praises the Philippines’ debt transparency, but clarity doesn’t ease the burden.

Is this growth just a post-COVID rebound? The -9.5% contraction in 2020—Asia’s worst—followed draconian lockdowns critics dubbed a “dictatorship.” The 7.6% surge in 2022 and 6.1% average growth from 2021–2024 reflect pent-up demand and reforms, not enduring strength. Agriculture’s typhoon losses and trade vulnerabilities, amplified by U.S. protectionism, expose a brittle core.

Reforms like the CREATE MORE Act and PPP Code aim to draw investment by cutting corporate taxes (25% to 20%) and fast-tracking infrastructure. CREATE MORE, with rules issued in December 2024, could lure FDI amid a Trump-era supply chain shift. The PPP Code has spurred projects like Maria’s highway, with public investment at 5.3% of GDP in 2023. Yet, benefits tilt toward urban conglomerates. SMEs, employing 60% of workers, struggle with tax incentive access, and rural areas see PPPs as distant. NEDA’s Trabaho Para sa Bayan targets 3 million jobs by 2028, but its training focus may sideline informal workers.

Charting the Escape: Taming the Debt Beast Without Sacrificing the Poor

Slashing “freebies” like military pensions—austerity’s poster child—could ease debt but risks widening inequality. Ronald Reagan’s quip, “the success of a welfare program is how many people exit it,” applies to patronage-driven pensions, not social safety nets. Military pensions, a political sacred cow, drain billions. Cutting them could fund infrastructure, but without closing elite tax loopholes, savings won’t reach the marginalized. Austerity must be surgical, not savage.

Here’s a roadmap:

- Debt Restructuring with Grit: Negotiate longer maturities with multilateral lenders, using the Philippines’ debt transparency ranking as leverage. Channel savings into climate-resilient agriculture to shield farmers like Maria from typhoons.

- Tax the Elite, Not the Essentials: The Ease of Paying Taxes Act boosted revenue, but loopholes persist. Tax wealth and luxury goods to fund education and healthcare, shrinking the Gini gap.

- ASEAN as a Lifeline: With U.S. tariffs looming, deepen trade with Vietnam and Indonesia via ASEAN frameworks. Diversify exports—beyond BPO to marine biotechnology—to stabilize the $11.2 billion current account deficit.

- Empower SMEs, Connect Rural Roots: Simplify CREATE MORE incentives for SMEs with microfinance. Prioritize rural PPPs, ensuring Maria’s rice reaches markets.

The Final Gambit: Will Growth Lift All or Drown the Many?

The Philippines’ economic surge is a beacon in a turbulent world, but its debt volcano and inequality chasms threaten collapse. Maria’s highway could lead to prosperity—or a tollbooth for the elite. Growth must be more than a headline; it must lift sampans, not just superyachts. Will leaders defuse the debt timebomb, or bet on a boom that buries millions? The clock is ticking—choose wisely.

- Bam Aquino’s “Ideally Local” EJK Fantasy vs Trillanes’ ICC Reality – Why the Opposition Is Handing 2028 to Sara Duterte

- “Just Following Orders” Is Dead: How the Hague Just Turned Tokhang’s Finest Into International Fugitives

- From “Never Again” to “Ideally Here”: How Bam Aquino Defended the Impunity Machine

- From Diverticulitis to Detention: How a Fake CT Scan Landed Critics in the NBI Crosshairs

- Marcos’ “Teachers First” Mirage: ₱10,000 Allowance or Just Another Vote-Buying Photo-Op?

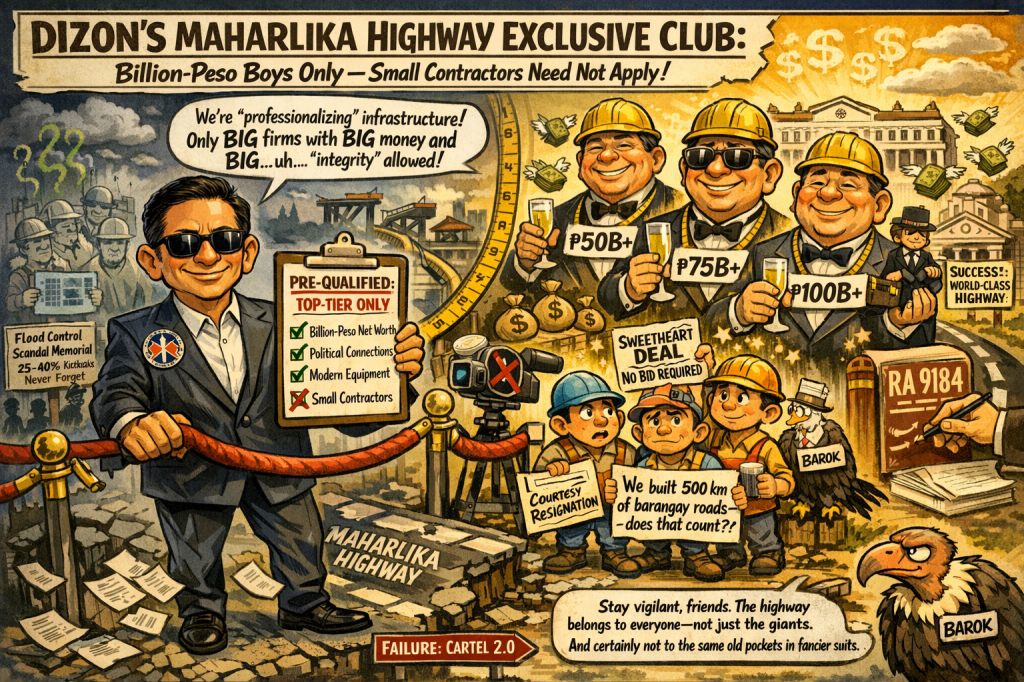

- Dizon’s Maharlika Highway Exclusive Club: Only Billion-Peso Boys Allowed (Small Contractors Need Not Apply)

- 2028 Elections Just Got Bloodier: Sara Declares War on Marcos While Impeachment Complaints Line Up Like Jeepneys in EDSA

- From Barangay Captain to Cabinet: Why 73% of Filipinos Think Bribery Is the Only Government Service That Actually Works

- Why Duterte Got the Fast-Track to The Hague but Bato & Bong Go Deserve a Full Constitutional Pageant

- Marcoleta’s Treason Fantasy: Why Charging Carpio for Peacetime “Betrayal” Is the Dumbest Thing You’ll Read This Week

- DOJ Caught Shielding Alleged Rapist Because He’s Their Sabungeros Golden Boy? The Ugly Truth Exposed

- PNP “Integrity Reforms”: Nartatez’s ICC Panic Button or Just Another Camp Crame Comedy Special?

Leave a comment