By Louis ‘Barok‘ C. Biraogo — April 30, 2025

Factories Shuttered, Dreams Deferred

IN Cebu’s vibrant furniture district, Pilita Castro, a third-generation woodcarver, surveys her workshop with despair. Her intricately carved narra tables, once a local treasure, sit unsold as Chinese imports—priced 30% lower—flood markets. “We’re drowning,” she says, her voice trembling. “My workers, my family—they’re losing everything.” Last year, her small business cut half its staff, echoing the 2,000 factory closures across Southeast Asia tied to Chinese overcapacity.

Contrast Pilita’s plight with Carlo Reyes, a 28-year-old call center agent in Manila’s Quezon City. Carlo thrives in the IT-BPM sector, projected to hit $59 billion by 2028. His steady income fuels dreams of a condo, a world away from manufacturing’s instability. “The work is tough, but it’s my future,” he says, navigating a Digital Cities 2025 app for upskilling courses.

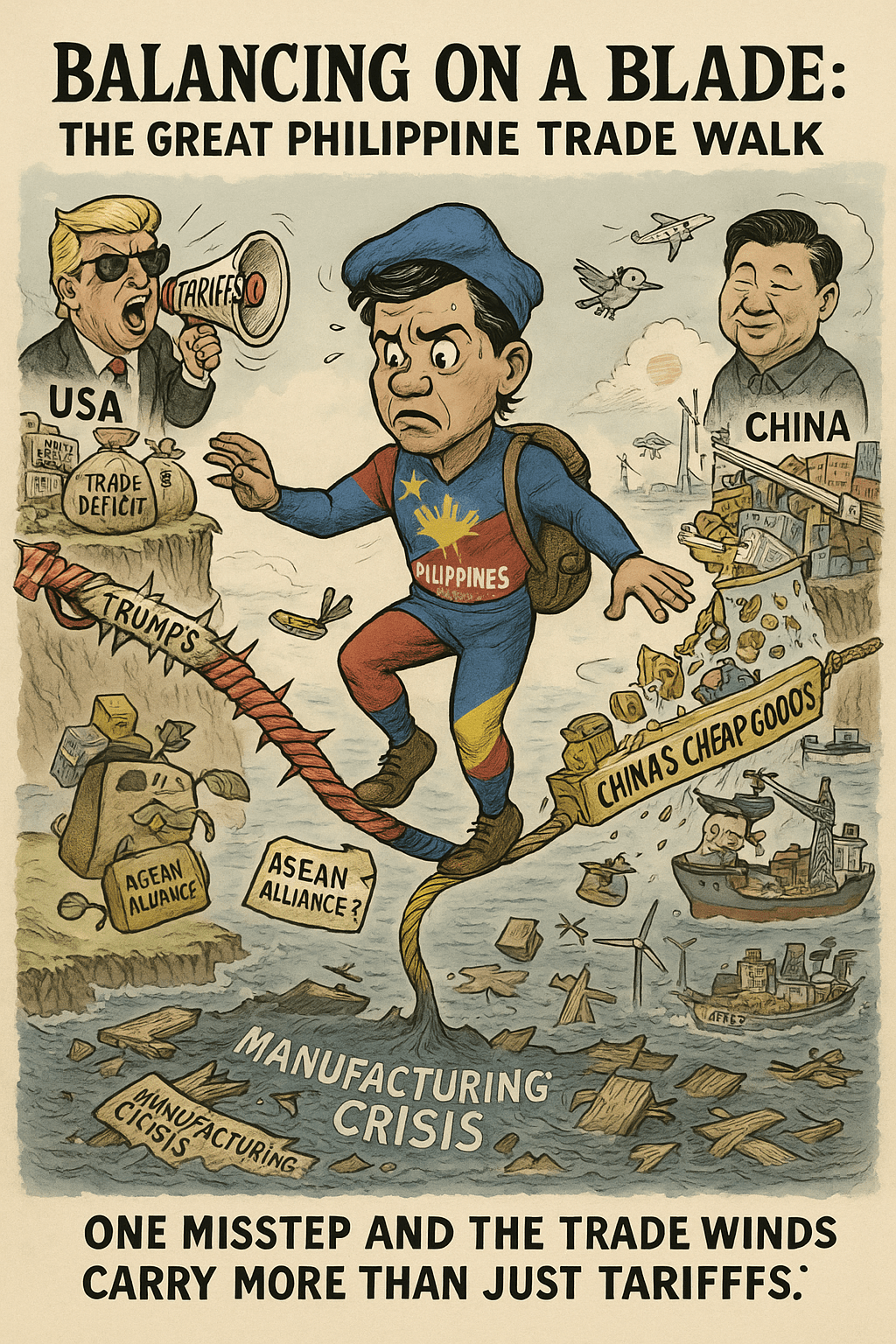

These stories reveal the Philippines’ economic divide in 2025. As U.S. President Donald Trump’s tariffs—initially 17% on Filipino goods, now paused at 10%—upend global trade, China redirects its industrial surplus to markets like the Philippines. Nomura shows a $34.5 billion surge in Chinese imports in 2024, correlating with sharp manufacturing slowdowns in basic metals, machinery, and furniture. Yet, BusinessWorld argues the Philippines is the “least exposed” to China’s economy, scoring 19 versus Singapore’s 179. The reality is nuanced: while the broader economy holds, sector-specific vulnerabilities crush livelihoods like Pilita’s.

Cheap Chinese goods bring mixed blessings. Disinflation lowers prices for consumers battered by high electricity costs, among ASEAN’s highest. But for manufacturers, it’s ruinous. Nomura links rising Chinese import shares to manufacturing declines, hitting basic metals hardest. Pilita’s workshop isn’t just a business; it’s a cultural legacy, now a casualty of Washington and Beijing’s trade war.

Trapped in a Global Trade Storm

Manila’s factories are battlegrounds in Trump and Xi Jinping’s trade war, but the Philippines’ woes are as geopolitical as economic. Trump’s tariffs, meant to shrink America’s trade deficit, have redirected Chinese exports to emerging markets. Nomura’s Euben Paracuelles warns that a prolonged U.S.-China trade war could deepen Beijing’s import penetration, with $34.5 billion in Chinese imports in 2024—up from $32.5 billion in electronics in 2022—signaling growing dependency. These goods, from steel to furniture, undercut local producers hamstrung by high power costs and a grid 40% owned by China’s State Grid Corporation.

BusinessWorld’s optimism rests on low Chinese FDI and a robust IT-BPM sector, but it ignores the South China Sea, where tensions threaten trade routes vital to Manila’s export-driven growth. The 2023 coast guard ship ramming near Second Thomas Shoal highlights the stakes. If Beijing escalates, as Nomura fears amid a U.S. security pullback, disrupted shipping lanes could spike export costs.

ASEAN could be a lifeline, but it’s divided. While Vietnam and Indonesia impose anti-dumping tariffs on Chinese goods, a unified response stalls. The Philippines, torn between U.S. alliances and China’s economic pull, risks becoming a pawn unless it acts decisively.

Forging a Resilient Future

The Philippines need not be a victim of global rivalries—but survival demands bold action with the urgency of a nation fighting for its economic soul. A comprehensive plan combines immediate protections with forward-thinking reforms, rooted in evidence and human impact.

Short-Term Defenses

First, diversify trade to curb reliance on China’s $34.5 billion import flood. Fast-tracking the UAE CEPA, set to quintuple bilateral trade, could open markets for Filipino electronics and agriculture. The RCEP, effective since 2022, grants tariff-free access to 14 Asia-Pacific nations, cushioning U.S. tariff blows. The Department of Trade and Industry must avoid delays, like RCEP’s 2022 ratification lag, that cost jobs.

Second, protect vulnerable sectors like Pilita’s furniture trade. Subsidies, inspired by Vietnam’s textile support, could cut production costs. Anti-dumping duties, as Indonesia applies to Chinese steel, are urgent. The Philippines imported $4 billion in Chinese steel in 2023, 10% cheaper than alternatives. Sourcing from Japan or South Korea, paired with tariffs, can shield local producers and diversify supply chains.

Long-Term Vision

The IT-BPM sector, Carlo’s anchor, is a growth engine. Targeting 2.5 million jobs by 2028, it’s insulated from trade shocks. The Digital Cities 2025 program, identifying 25 tech hubs, needs scaling. Nomura’s disinflation data supports Bangko Sentral ng Pilipinas rate cuts, freeing capital for DICT upskilling initiatives. Better broadband—lagging ASEAN peers—can transform provinces like Iloilo into IT-BPM centers, redistributing wealth beyond Manila.

Supply chain resilience requires infrastructure leaps. Partnerships with Japan and the U.S., like UPS’s $250 million Clark Airport hub, can modernize ports. The U.S.’s $500 million in 2025 military financing signals trust. Redirecting FDI to port upgrades could slash shipping costs, countering Trump’s 10% tariff.

Diplomatically, ASEAN-led mediation is critical. President Marcos’s 2024 missile withdrawal proposal shows pragmatism. Manila should spearhead an ASEAN task force to ease South China Sea tensions, securing trade routes. Bilateral deals with Japan and South Korea, per 2024 MOUs, can diversify electronics supply chains, loosening China’s grip.

Closing

Pilita Castro locks her workshop nightly, unsure if her craft will endure. Carlo Reyes dreams of a tech-driven future. Their paths converge in Manila’s choices. The Philippines can’t stop the U.S.-China trade war, but it can refuse to be its casualty. By diversifying trade, fortifying industries, and betting on tech and alliances, Manila can transform crisis into opportunity. Pilita’s tables and Carlo’s ambitions demand a nation that fights for its people—one policy, one partnership, one resilient step at a time.

Citations:

- Nomura’s import-growth correlation and exposure score: Nomura Connects Asia Economic Monthly

- IT-BPM’s $59B potential and Digital Cities 2025: Philippine News Agency, PIA

- Chinese import data ($34.5B in 2024): TradingEconomics

- BusinessWorld’s “least exposed” claim: BusinessWorld Online

- South China Sea tensions and ASEAN role: War on the Rocks, BusinessWorld Online

- RCEP and UAE CEPA: PIDS, Philippine News Agency

- Anti-dumping measures and steel imports: Connecta Network

- ₱75 Million Heist: Cops Gone Full BanditBy Louis ‘Barok‘ C. Biraogo — April 6, 2025 IF YOU think the biggest threat to justice comes from criminals, think again. In a raid gone disastrously wrong, 31 police officers from the National Capital Region Police Office (NCRPO) allegedly walked away with ₱75 million in loot—after disabling CCTVs, cracking a vault, and leaving behind… Read more: ₱75 Million Heist: Cops Gone Full Bandit

- ₱6.7-Trillion Temptation: The Great Pork Zombie Revival and the “Collegial” Vote-Buying CircusBARSc and the Art of Theatrical Transparency: 20 Extra Hours of Scrutiny, Zero Hours of Shame By Louis ‘Barok‘ C. Biraogo — December 31, 2025 MGA ka-kweba, gather ’round the fire because the 20th Congress is serving up another steaming pile of budgetary baloney, this time with a side of “allocables” that smell suspiciously like… Read more: ₱6.7-Trillion Temptation: The Great Pork Zombie Revival and the “Collegial” Vote-Buying Circus

- ₱1.9 Billion for 382 Units and a Rooftop Pool: Poverty Solved, Next Problem PleaseFeaturing special guest stars Bongbong Marcos and Isko Moreno in the feel-good blockbuster “Unity Tayo, Picture Muna” By Louis ‘Barok‘ C. Biraogo — December 2, 2025 1. The Grand Illusion: A Photo-Op for Strange Bedfellows Yesterday, in the heart of Sta. Cruz, Manila, the nation witnessed a masterclass in political alchemy. There they stood —… Read more: ₱1.9 Billion for 382 Units and a Rooftop Pool: Poverty Solved, Next Problem Please

- ₱1.35 Trillion for Education: Bigger Budget, Same Old Thieves’ BanquetMain Course: Overpriced Classrooms and Confidential-Fund Gravy By Louis ‘Barok‘ C. Biraogo — January 1, 2026 MGA ka-kweba, Senator Bam Aquino calls the ₱1.35 trillion earmarked for education in the 2026 national budget a “historic victory.” The largest education fund in Philippine history, he says—more classrooms, free school meals, bigger support for the Free College… Read more: ₱1.35 Trillion for Education: Bigger Budget, Same Old Thieves’ Banquet

- ₱1 Billion Congressional Seat? Sorry, Sold Out Na Raw — Si Bello Raw Ang Hindi BumiliWindow shopping lang daw si Tito Bebot sa isang bilyon. Bow. By Louis ‘Barok‘ C. Biraogo — November 30, 2025 ONE billion pesos. Not a hundred million. Not five hundred million. One full, shiny, obscene billion pesos — allegedly dangled by no less than the President of the Republic in exchange for Silvestre Bello III… Read more: ₱1 Billion Congressional Seat? Sorry, Sold Out Na Raw — Si Bello Raw Ang Hindi Bumili

- “We Will Take Care of It”: Bersamin’s P52-Billion Love Letter to CorruptionFrom the Supreme Court bench to the kickback throne: a love story written in cash By Louis ‘Barok‘ C. Biraogo — November 20, 2025 MGA ka-kweba, while Metro Manila drowns and thousands of families float in their own homes, some pinoys are busy floating money—not water, but cold, hard cash. A cool P100 billion earmarked… Read more: “We Will Take Care of It”: Bersamin’s P52-Billion Love Letter to Corruption

- “Skewed Narrative”? More Like Skewered Taxpayers!Zaldy Co’s ₱13.8B Vacation vs. Your Flooded Barangay By Louis ‘Barok‘ C. Biraogo — November 9, 2025 HAYY, mga ka-kweba, gather ’round the cave. The air reeks of desperation, expensive cologne, and the unmistakable stench of a ₱13.8 billion budget heist. Former Ako Bicol party-list Representative Zaldy Co – now conveniently abroad – wants to… Read more: “Skewed Narrative”? More Like Skewered Taxpayers!

- “Scared to Sign Vouchers” Is Now Official GDP Policy – Welcome to the Philippines’ Permanent Paralysis EconomyMonsod’s Diagnosis: The Bureaucracy Didn’t Freeze from Corruption—It Froze from the Sudden Threat of Actually Doing Its Job By Louis “Barok” C. Biraogo –– February 3, 2026 LET US begin with a simple image: a child in a flooded Manila barangay, waist-deep in filthy water, clutching a plastic basin that serves as both toy and… Read more: “Scared to Sign Vouchers” Is Now Official GDP Policy – Welcome to the Philippines’ Permanent Paralysis Economy

- “Robbed by Restitution?” Curlee Discaya’s Tears Over Returning What He Never EarnedAccountability Feels Like Hold-up When You’re the One Holding the Bag By Louis ‘Barok‘ C. Biraogo — January 21, 2025 WELCOME back to the Cave, mga kababayan. Today, let’s talk about the latest Senate comedy: Pacifico “Curlee” Discaya crying foul like a robbery victim simply because the government asked him to return money he allegedly… Read more: “Robbed by Restitution?” Curlee Discaya’s Tears Over Returning What He Never Earned

- “My Brother the President Is a Junkie”: A Marcos Family Reunion SpecialRated R for Rally, Rivalry, and Really No Evidence. By Louis ‘Barok‘ C. Biraogo — November 18, 2025 PART 1: THE OPENING GAMBIT – A HOUSE OF CARDS ON FIRE Mga ka-kweba, welcome to the greatest show on earth: Philippine politics, where a sister stands before hundreds of thousands and publicly accuses her own brother… Read more: “My Brother the President Is a Junkie”: A Marcos Family Reunion Special

- “Mapipilitan Akong Gawing Zero”: The Day Senator Rodante Marcoleta Confessed to Perjury on National Television and Thought We’d Clap for the CreativityHow to Confess to Perjury in One Sentence and Still Think “Utang na Loob” Is a Valid Defense By Louis ‘Barok‘ C. Biraogo — December 7, 2025 MGA ka-kweba, grab your popcorn and your Revised Penal Code. The Learned Gentleman from SAGIP (a.k.a. Our Obfuscator-in-Chief, a.k.a. the man who looked the camera dead in the… Read more: “Mapipilitan Akong Gawing Zero”: The Day Senator Rodante Marcoleta Confessed to Perjury on National Television and Thought We’d Clap for the Creativity

- “Bend the Law”? Cute. Marcoleta Just Bent the Constitution into a PretzelWhen Grandstanding Met the Power of the Purse and the Constitution Wept By Louis ‘Barok‘ C. Biraogo — November 24, 2025 MGA ka-kweba, ladies and gentlemen of the jury, grab your popcorn and your Constitutions. Tonight we watch a neophyte senator turn a ₱6.5-billion budget hearing into his personal episode of Pera o Bayan: The… Read more: “Bend the Law”? Cute. Marcoleta Just Bent the Constitution into a Pretzel

Leave a comment