By Louis ‘Barok‘ C. Biraogo — June 23, 2025

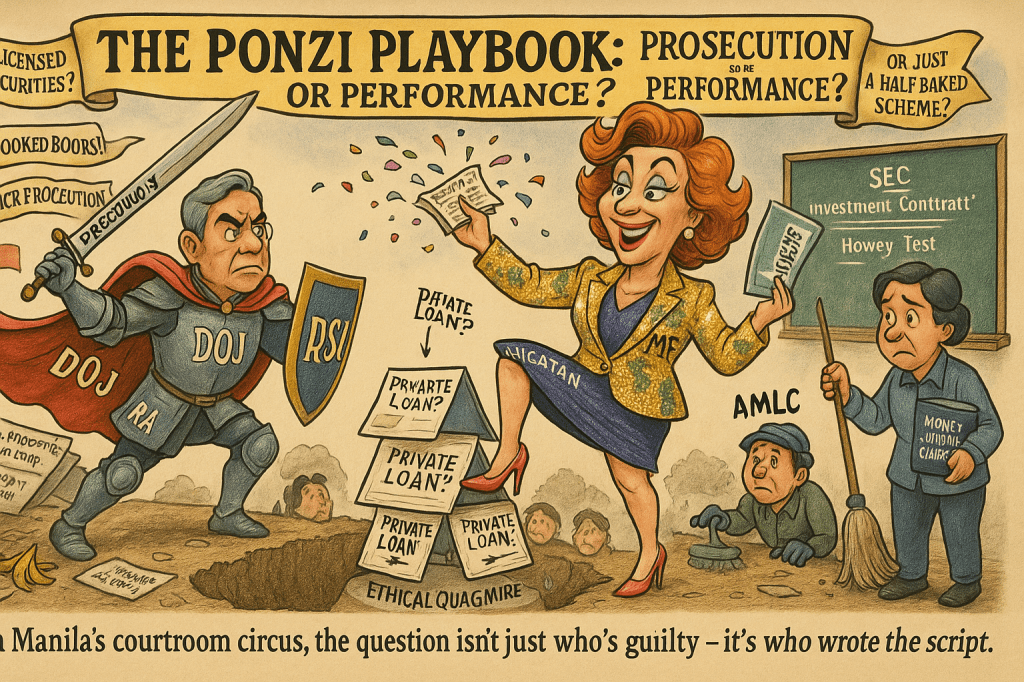

ONCE a rising star in Manila’s business elite, Maria Francesca “Mica” Tan now faces the DOJ’s wrath, accused of masterminding a Ponzi scheme with MFT Group’s dazzling 12–18% return promises. But the DOJ’s abrupt dismissal of money laundering charges sparks a blazing question: Is this a bold strike against fraud or a regulatory overreach dressed in justice’s robes?

The DOJ’s Case: A Financial Takedown or a Shaky Gambit?

The Prosecution’s Smoking Gun

The DOJ, armed with the SEC’s 2024 complaint, charges MFT Group with flouting the Securities Regulation Code (RA 8799). The indictment’s core arguments pack a punch:

- Unlicensed Securities Peddling (Section 8): MFT’s contracts, dangling 12–18% returns, scream “investment contract” under the Howey Test, demanding SEC registration. SEC v. Oudine Santos (2014) confirms that broad solicitations, even to a select crowd, trigger Section 8.1. MFT’s alleged online pitches and investor NDAs fit the bill.

- Cooked Books and Deception (Sections 26–28): The SEC alleges 17 counts of misrepresentation in MFT’s 2018–2021 financial statements, including fabricated dividend income, violating Section 177 of the Revised Corporation Code (RA 11232) and SRC’s fraud bans. The “Ponzi scheme” label suggests MFT paid old investors with new money, a tactic crushed in Power Homes Unlimited Corp. v. SEC (2008).

- Rock-Solid Evidence? The DOJ claims “reasonable certainty of conviction,” pointing to MFT’s post‑dated checks and NDAs as hallmarks of an unregistered securities scheme. Power Homes Unlimited Corp. v. SEC (G.R. No. 164182, February 2008) bolsters this, with the Supreme Court affirming strict SRC enforcement to protect investors from disguised investment contracts.

The DOJ’s case paints MFT as a house of financial cards, luring investors with impossible promises and fake profits. Justice Secretary Jesus Crispin “Boying” Remulla frames it as a defense of transparency, aligning with SEC MC No. 19 (2016) and Article 19 of the Civil Code’s good-faith mandate.

Holes in the Prosecution’s Armor

Yet, the DOJ’s case isn’t bulletproof. The dismissal of money laundering charges (RA 9160) raises red flags:

- No Dirty Money Trail? If MFT ran a Ponzi empire, where’s the laundered cash? RA 9160 ties money laundering to predicate crimes like SRC violations, but the DOJ’s referral to the Anti-Money Laundering Council (AMLC) without charges suggests weak evidence. Estrada v. Sandiganbayan (2001) cautions against prosecutorial leaps without proof.

- Securities or Loans? MFT insists its deals were private loans, not securities, potentially sidestepping SRC oversight. Its “lender” defense—anchored in NDAs and bilateral agreements—frames the transactions as exclusive, private arrangements. MFT could argue these lacked the public solicitation required to trigger securities regulation, challenging claims of a public offering.

- Due Process Fumbles: MFT claims the DOJ hid SEC complaints during the preliminary investigation, violating Rule 112 of the Rules of Court. Salonga v. Paño (1985) struck down proceedings for such lapses, and if proven, this could unravel the indictment.

The DOJ’s focus on SRC violations while sidestepping money laundering feels like a half-drawn sword. Without a clear illicit cash trail, the Ponzi label wobbles, and MFT’s loan argument could expose SEC overreach.

Remulla’s Mission: Guardian of Justice or Overzealous Enforcer?

A Stand for Accountability

Remulla’s push against MFT signals a commitment to market integrity. His call for transparency mirrors SEC MC No. 19 (2016) and Article 19 of the Civil Code, demanding corporate honesty. SEC v. Prosperity.Com (2011) backs his stance, with the Supreme Court upholding aggressive SRC enforcement to shield investors. By targeting MFT’s alleged fraud, Remulla aims to deter shady schemes, reinforcing that “the law is a standard for all.”

Remulla’s push against MFT signals a commitment to market integrity. His call for transparency mirrors SEC MC No. 19 (2016) and Article 19 of the Civil Code, demanding corporate honesty. SEC v. Oudine Santos (G.R. No. 195542, 2013) backs his stance, with the Supreme Court affirming that structured profit-sharing schemes—even those cloaked as private arrangements—must be registered to shield investors. By targeting MFT’s alleged fraud, Remulla aims to deter shady schemes, reinforcing that “the law is a standard for all.”

Questions of Balance

Still, Remulla’s approach invites scrutiny:

- Selective Focus? The DOJ’s laser on MFT, while other lending schemes skate free, raises questions of consistency. Estrada v. Sandiganbayan (2001) warns against uneven prosecution, and the timing—amid broader political currents—might suggest a high-profile target for public optics.

- Money Laundering Mismatch: Dropping RA 9160 charges while pushing a Ponzi narrative creates a logical disconnect. A clearer explanation of this pivot would strengthen the DOJ’s credibility.

- Regulatory Chill? Remulla’s broad compliance call, while principled, risks discouraging legitimate ventures. SEC v. Prosperity.Com (2011) cautioned against overly wide “securities” definitions, and MFT’s loan defense could highlight this tension.

Remulla’s intent to protect investors is clear, but the DOJ must ensure its pursuit doesn’t blur into overreach or selective enforcement.

Ethical Quagmires: Greed, Negligence, and Fairness

Isla Lipana’s Audit Abyss

The SEC’s claim that Isla Lipana & Co. (PwC’s affiliate) issued clean audit opinions despite MFT’s fake dividends is a scandal in itself. PSA 200 and RA 9298 demand auditors exercise skepticism and ensure accurate financials. Tayag v. CA (1992) held auditors liable for negligence, and Isla Lipana’s role—whether sloppy or complicit—casts a shadow over auditing integrity. Were they duped, or did they cash in on MFT’s books?

MFT’s Due Process Plea

MFT’s allegation of being blindsided by SEC complaints during the DOJ’s probe screams procedural foul. Salonga v. Paño (1985) mandates notice and response rights in preliminary investigations. If MFT’s claim holds, the indictment risks collapse, underscoring the need for airtight fairness in high-stakes cases.

Systemic Rot

From MFT’s alleged deceit to Isla Lipana’s questionable audits and the DOJ’s aggressive tactics, this case exposes ethical cracks. Investors, promised riches, are left burned, while regulators and professionals skirt accountability. It’s a stark reminder: greed and negligence thrive when oversight falters.

Fixing the Fight: Paths Forward

For Regulators

- Define the Line: The SEC must clarify when loans become securities, per Power Homes Unlimited Corp. v. SEC (2008), to avoid stifling innovation while protecting investors.

- Audit Crackdown: The Professional Regulation Commission (PRC) should probe Isla Lipana under RA 9298, setting a precedent against lax auditing.

For Courts

- Demand Proof: The Batangas RTC, handling syndicated estafa, must rigorously apply People v. Mateo (2017), requiring clear evidence of fraudulent intent. If MFT’s deals were loans, not a syndicate’s scam, the case could falter.

- Uphold Fairness: Courts must ensure MFT’s procedural rights, per Salonga v. Paño (1985), to prevent tainted indictments.

For Investors

- Stay Wary: Promises of 12–18% returns are red flags. Demand SEC registration and reject NDAs hiding risks. MFT’s fate—scam or misjudged startup—will clarify the stakes.

Final Call: Justice or a Regulatory Reckoning?

The DOJ’s indictment of Mica Tan brands her MFT Group as a Ponzi predator, but dropped money laundering charges and a viable “loan” defense muddy the waters. Isla Lipana’s audit failures and MFT’s due process claims expose deeper flaws in the system. Remulla’s push for accountability is laudable, but without a clear cash trail or procedural rigor, the case teeters on shaky ground. Keep your eyes peeled: If the DOJ’s crusade crumbles, it’ll unmask a system more skilled at headlines than justice.

Sources:

- Securities Regulation Code (RA 8799)

- SEC v. Oudine Santos (G.R. No. 195542, 2014)

- Revised Corporation Code (RA 11232)

- Power Homes Unlimited Corp. v. SEC (G.R. No. 164182, 2008)

- SEC v. Prosperity.Com (G.R. No. 164197, 2012)

- SEC MC No. 19 (2016)

- Article 19 of the Civil Code

- Estrada v. Sandiganbayan (G.R. No. 148560, 2001)

- Rule 112 of the Rules of Court

- Salonga v. Paño (G.R. No. L-59524, 1985)

- Tayag v. CA (G.R. No. 95229, 1992)

- People v. Mateo (G.R. No. 210612, 2017)

- Rappler, “DOJ finds sufficient evidence to indict Mica Tan over illegal investment scheme,” June 19, 2025

- Bilyonaryo, “Batangas court issues arrest warrant against Mica Tan, 7 others for syndicated estafa,” May 9, 2025

- Kwebanibarok, “Mica Tan’s Great Escape,” June 8, 2025

- Manila Bulletin, “Owners, officers of MFT Group, Foundry Ventures should heed subpoenas,” April 23, 2024

- X posts: @bworldph, @Abogado_PH, @bilyonaryo_ph, @ANCALERTS, @rapplerdotcom, @gmanews (June 19–20, 2025)

Disclaimer: This is legal jazz, not gospel. It’s all about interpretation, not absolutes. So, listen closely, but don’t take it as the final word.

- “Forthwith” to Farce: How the Senate is Killing Impeachment—And Why Enrile’s Right (Even If You Can’t Trust Him)

- “HINDI AKO NAG-RESIGN!”

- “I’m calling you from my new Globe SIM. Send load!”

- “Mahiya Naman Kayo!” Marcos’ Anti-Corruption Vow Faces a Flood of Doubt

- “Meow, I’m calling you from my new Globe SIM!”

- “PLUNDER IS OVERRATED”? TRY AGAIN — IT’S A CALCULATED KILL SHOT

- “Several Lifetimes,” Said Fajardo — Translation: “I’m Not Spending Even One More Day on This Circus”

- “Shimenet”: The Term That Broke the Internet and the Budget

- “We Did Not Yield”: Marcos’s Stand and the Soul of Filipino Sovereignty

- “We Gather Light to Scatter”: A Tribute to Edgardo Bautista Espiritu

- $150M for Kaufman to Spin a Sinking Narrative

- $2 Trillion by 2050? Manila’s Economic Fantasy Flimsier Than a Taho Cup

Leave a comment