By Louis ‘Barok‘ C. Biraogo — July 21, 2025

BREAKING: Local journalist shocked—SHOCKED—to discover that legislation called the ‘Capital Markets Efficiency Promotion Act (CMEPA)’ might actually promote capital markets efficiently. In other news, water remains wet, politicians remain disappointing, and your columnist remains perpetually surprised by predictable outcomes. But stick around, because this rabbit hole of regulatory capture goes deeper than a crypto bro’s explanation of blockchain.

Effective July 1, 2025, this law is peddled as a golden ticket to financial fairness, but in a nation where 75% of families have no savings, per IBON Foundation, it’s more like a velvet rope barring the poor from the elite’s stock market soiree. Marcos Jr.’s “inclusive capital markets” deserve the same skeptical side-eye as his father’s “New Society” pipe dreams. Below, I skewer the ironies, dissect the spin, autopsy the fake news frenzy, tally the human cost, and demand fixes that bite.

1. Exposing the Absurd: Stock Tips for Starving Tricycle Drivers?

The Laughable ‘Empowerment’ Charade

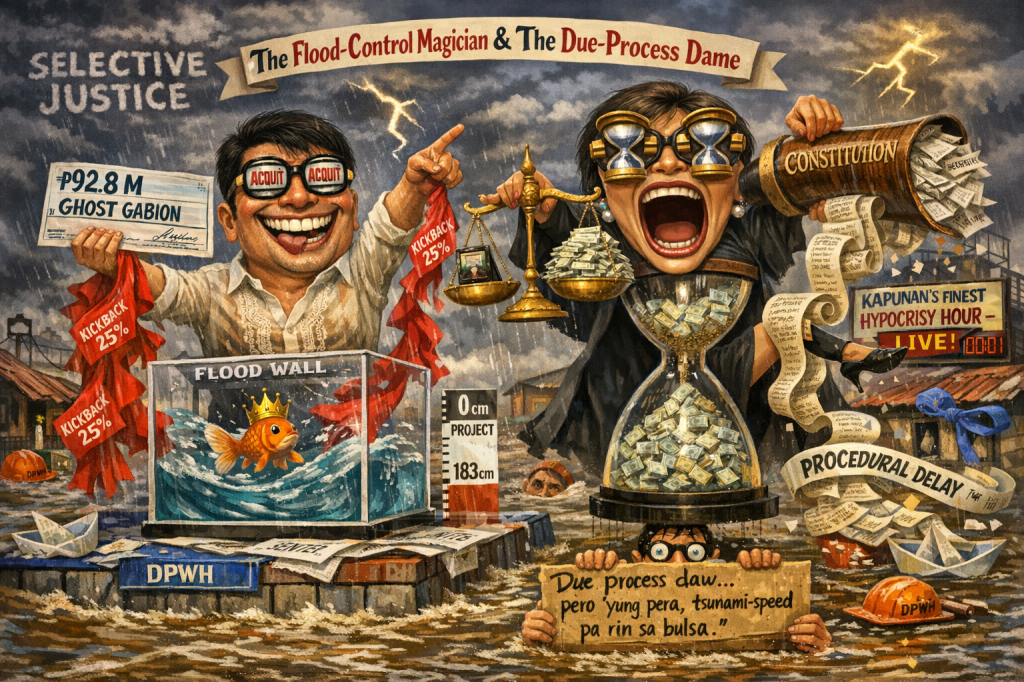

The Department of Finance (DOF) hails CMEPA as a great equalizer, “leveling the playing field” for all Filipinos. But with IBON Foundation reporting 75% of families—20.1 million households—without a peso in savings in 2024, this is like handing a stockbroker’s license to a sari-sari store owner who can’t afford her next sack of rice. The Philippine Stock Exchange (PSE) as a path to prosperity? For most, it’s as reachable as a penthouse in Makati. Only 56% of adults had bank accounts in 2021 (BSP data), and 82% of retail investors lose money in markets, a tidbit the PSE buries like a bad bet. Urging the poor to trade stocks because the stock transaction tax (STT) dropped from 0.6% to 0.1% is not empowerment—it’s a cruel prank, like gifting a yacht to someone drowning in debt.

Fake News Whining: The DOF’s Pot-Meets-Kettle Moment

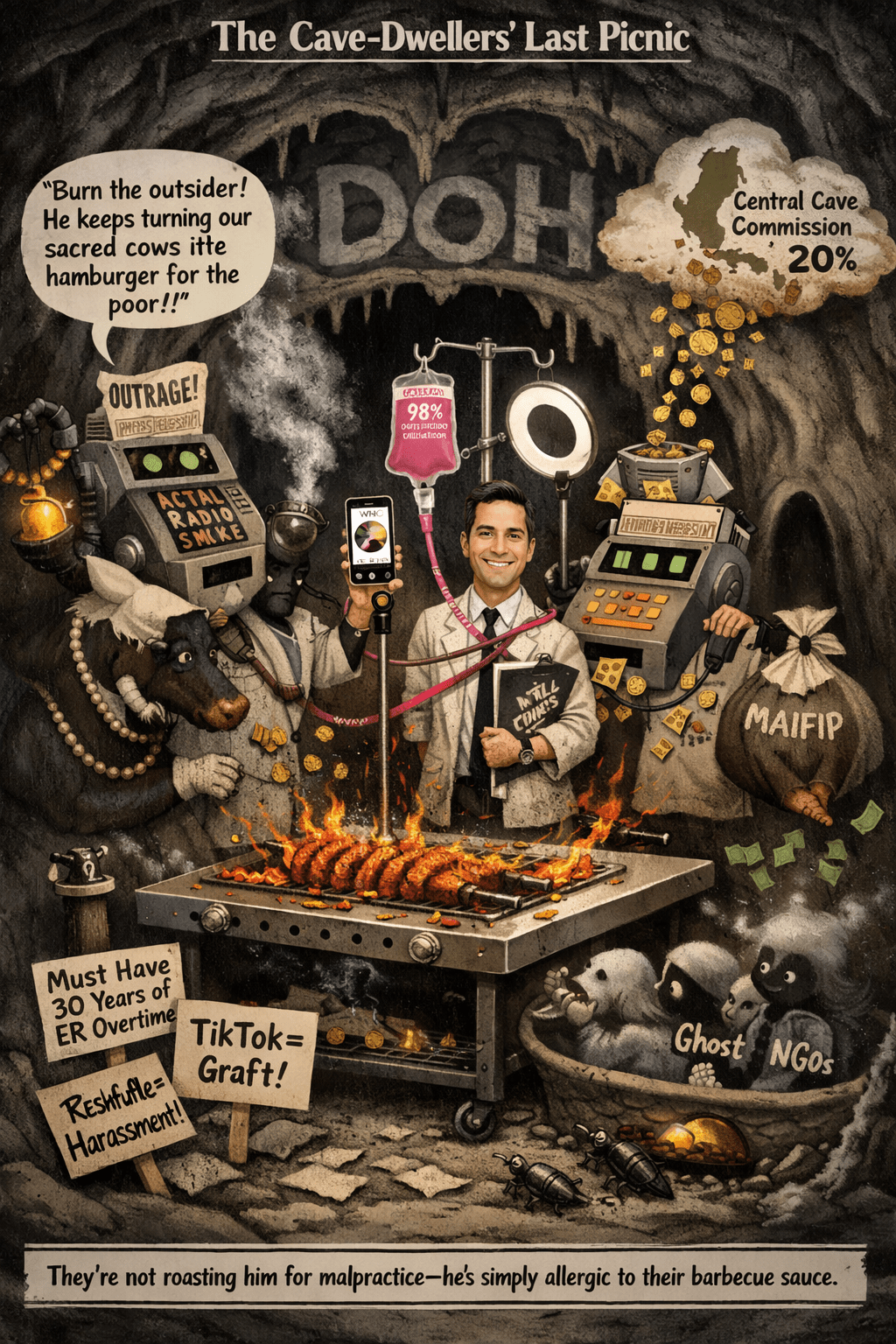

The DOF’s hand-wringing over “fake news” about a 20% tax on all savings is peak hypocrisy. Social media memes screamed that entire deposits were being taxed, sparking panic. But in a country where only 25% of adults grasp basic finance (2015 BSP survey), the DOF’s jargon-laden press releases are as useful as a Latin dictionary to a jeepney driver. Instead of flooding TikTok with a market vendor explaining the tax in Tagalog, the government left the stage to clickbait clowns. The result? A “20% grab” myth that fueled bank-run fears. The DOF decries misinformation but sowed the seeds with its elitist, incomprehensible messaging.

2. Slicing the Spin: Fairness for Tycoons, Crumbs for the Commoner

For CMEPA: A Progressive Facade with Plutocrat Perks

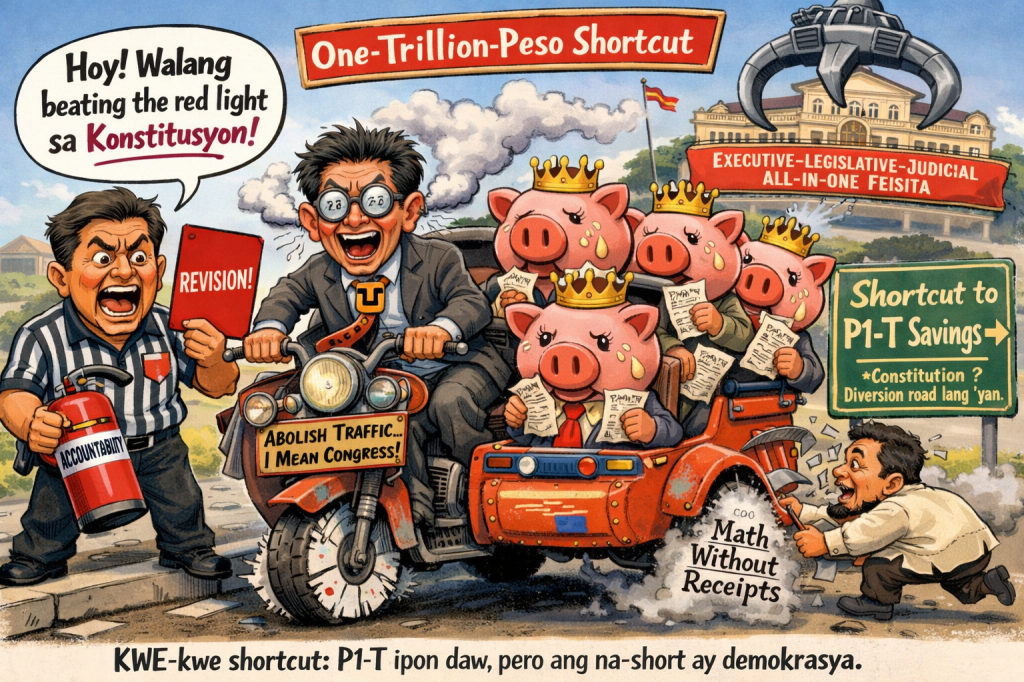

The DOF, led by Ralph Recto, and tax lawyer Benedicta Du-Baladad, crow that CMEPA’s 20% tax on long-term deposit interest—previously exempt for over five years—ends a giveaway to the wealthy. BSP data shows only 0.4% of deposits enjoyed this exemption, proof it coddled the rich. Slashing the STT to 0.1% and axing documentary stamp taxes (DST) on investment funds is pitched as opening the market to all, potentially tripling retail stock accounts to 2–3 million. Marcos Jr. boasts of ₱25 billion in revenue by 2030, hinting at funds for public good.

But this “fairness” is a flimsy mask. Why not a tiered tax—10% for deposits under ₱100,000, 30% for those over ₱5 million? Such a structure would actually dent inequality, sparing the nanay saving ₱50 a week while hitting tycoons hard. Instead, the flat 20% tax smells of cowardice, dodging the chance to truly soak the rich. The STT cut benefits urban yuppies with spare cash, not rural vendors. PSE’s Ramon Monzon claims it lures foreign investors, but this trickle-down fairy tale rarely reaches the provinces—just look at the 1990s, when market booms fattened Manila’s wallets while rural poverty festered.

Against CMEPA: A Gourmet Feast for the Famished

Sonny Africa of IBON Foundation nails it: “This is like inviting starving people to a gourmet buffet they can’t afford.” With 75% of Filipinos saving nothing, per BSP’s 2024 survey, CMEPA’s market perks are a mirage. The 20% tax on interest stings small savers—a ₱100 loss on a ₱5,000 deposit’s interest is a week’s groceries—while tycoons shrug off millions. Africa argues for wages, pensions, and social protections over risky stock bets. Banks, facing pricier long-term deposits, may hike lending rates, crushing micro-entrepreneurs. The DOF’s “invest, don’t gamble” sermon, echoed by Monzon, is patronizing nonsense. Telling a sakla player to buy stocks is like scolding a shipwreck survivor for not swimming faster—ignoring the poverty that sank them.

3. Autopsy of a Fake News Fiasco: Distrust’s Deadly Dance

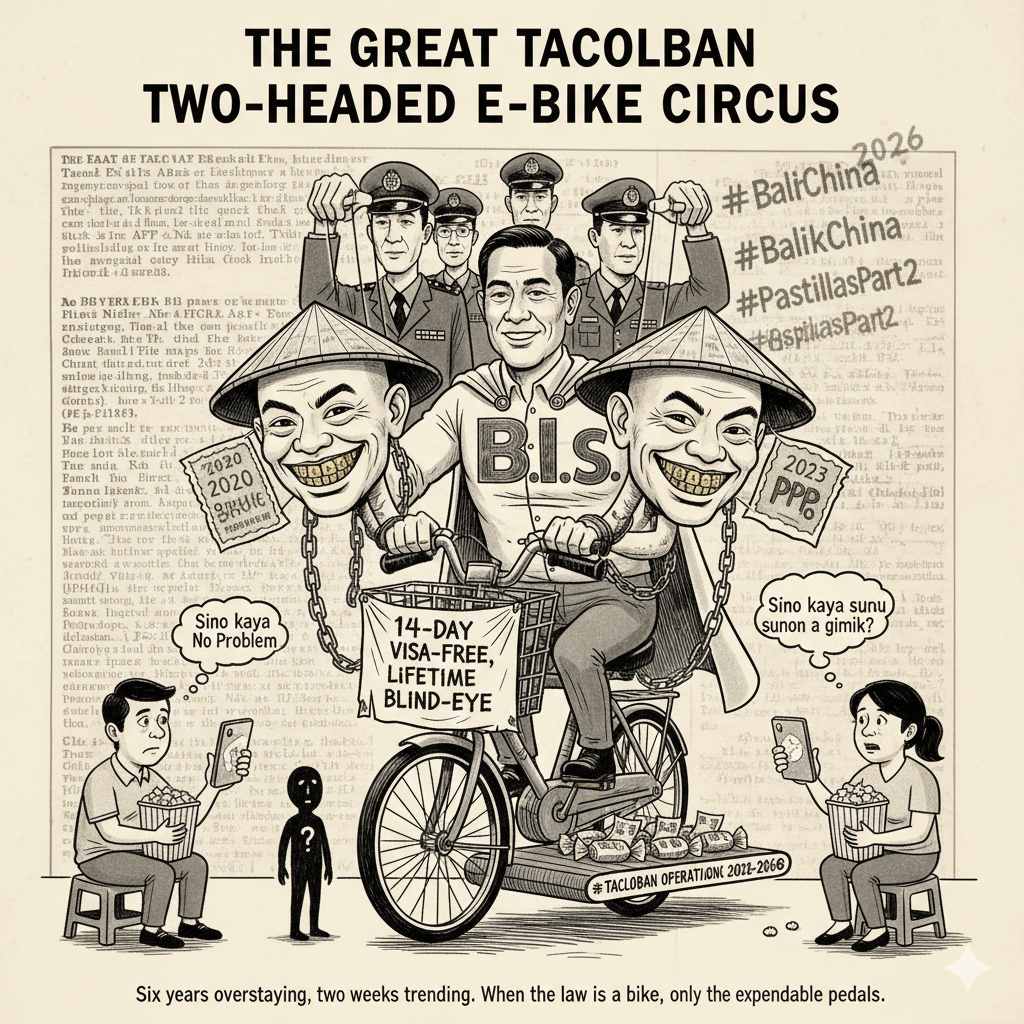

The “20% grab” panic that swept social media is a grotesque symptom of systemic rot. Memes painting CMEPA as a savings heist outran the DOF’s robotic clarifications that only interest, not principal, is taxed—and has been since 1998 for most deposits. The gulf between the DOF’s “non-retroactive withholding tax” babble and the public’s visceral fear (“they’re looting my account!”) reveals a nation scarred by distrust, from Marcos Sr.’s martial law to Duterte’s broken promises. Clickbaiters fanned the flames, but the DOF’s failure to speak in plain Filipino—or deploy a trusted tindera on TikTok—left the poor vulnerable to panic. Financial illiteracy (only 2% understand stocks, per 2019 data) turned a technical tweak into a perceived robbery.

Barok’s Law: Every tax reform must come with a TikTok explainer narrated by a jeepney driver, not a suit. This isn’t just a jab—it’s a demand for communication that meets Filipinos in their barangays, not boardrooms. The DOF’s elitist aloofness is as guilty as any viral meme.

4. Human Cost: Taxing the Poor’s Last Peso

Meet Maria, a Quezon City minimum-wage worker who saves ₱5,000 by skipping meals, squirreling away ₱50 weekly. Her account earns ₱500 in interest annually; CMEPA’s 20% tax snatches ₱100—enough for a week’s rice and tuyo. A tycoon with ₱50 million in deposits loses ₱1 million in interest tax but doesn’t blink. This is CMEPA’s brutal math: the poor bleed, the rich yawn. The DOF’s and Monzon’s “invest, don’t gamble” mantra mocks Maria’s reality. She can’t afford to lose ₱100, let alone risk it on stocks, where volatility could erase her savings. PSE’s own data whispers the truth: most retail investors lose money. For Maria, a bad trade means hungry kids.

This isn’t just about taxes—it’s about a system that dangles risky markets before the poor without life rafts. The government’s failure to pair CMEPA with financial education or social safety nets leaves Maria drowning in a sea of elite-driven reforms.

5. Fixes with Fangs: Rescuing a Reform Gone Rogue

To salvage CMEPA from its elitist drift, the government must act with guts:

- For Equity: Enact a small saver exemption—no tax on the first ₱10,000 of interest income—to protect workers like Maria. Subsidize PERA contributions for informal workers—vendors, drivers, farmers—so they can build real retirement security, not just tax breaks for corporate drones.

- For Trust: Deploy a DOF Truth Squad—mobile vans with kababayan translators speaking Tagalog, Bisaya, or Ilocano, demystifying taxes and stocks in markets and barangays. This would drown out misinformation with trust rooted in community.

- For Accountability: Force the SEC to slap trading apps with warnings: “82% of retail investors lose money.” Like cigarette packs, these would counter the PSE’s glossy hype, saving novices from financial ruin.

Conclusion: A Mirage for the Masses

CMEPA is Marcos Jr.’s shiny bauble, cloaked in “inclusive capital markets” rhetoric as credible as his father’s utopian slogans. Its tax fairness and market perks enrich the urban middle class and foreign investors, while the 75% of Filipinos with no savings face slashed interest and risky stocks they can’t navigate. The fake news firestorm wasn’t just a misunderstanding—it was the cry of a distrustful nation ignored by technocrats. For the nanay sacrificing meals for ₱50 a week, CMEPA is another empty acronym that won’t feed her kids. Without bold equity measures, mass education, and trust-building, this law will widen the gap between Manila’s towers and the provinces’ shacks. True reform doesn’t just pave the field—it ensures the poor aren’t trampled on it.

Key Citations

- Government & Policy Sources

- DOF Statement on CMEPA Fake News

Department of Finance clarification that CMEPA taxes only interest income, not principal, and addresses misinformation, July 18, 2025.

- Research & Advocacy

- IBON Foundation

Source for 75% of Filipino families having no savings in 2024, cited in critique of CMEPA’s relevance to the poor. - BSP Financial Inclusion Survey 2015 (PDF)

Data showing only 25% of Filipinos understand basic financial concepts, used to highlight financial illiteracy. - BSP Consumer Finance Survey 2024 (PDF)

Source for 75% of Filipino families having no savings, reinforcing critiques of CMEPA’s accessibility. - BSP Financial Literacy Report 2019. (PDF)

Data indicating only 2% of Filipinos understand stocks, underscoring risks of market-based reforms.

- News & Analysis

- ABS-CBN News on CMEPA Clarification

News report detailing DOF’s response to fake news and banking industry impacts, July 17, 2025. - Philstar.com on CMEPA and Small Savers

Article analyzing CMEPA’s regressive impact on small savers, featuring Sonny Africa’s critique, July 18, 2025. - Philstar.com on Fake News Spread

Report on the viral misinformation about a 20% tax on all savings, July 17, 2025. - Rappler on CMEPA Impact

Discussion of CMEPA’s economic benefits and risks, including revenue projections, June 27, 2025.

- ₱75 Million Heist: Cops Gone Full Bandit

- ₱6.7-Trillion Temptation: The Great Pork Zombie Revival and the “Collegial” Vote-Buying Circus

- ₱1.9 Billion for 382 Units and a Rooftop Pool: Poverty Solved, Next Problem Please

- ₱1.35 Trillion for Education: Bigger Budget, Same Old Thieves’ Banquet

- ₱1 Billion Congressional Seat? Sorry, Sold Out Na Raw — Si Bello Raw Ang Hindi Bumili

- “We Will Take Care of It”: Bersamin’s P52-Billion Love Letter to Corruption

- “Skewed Narrative”? More Like Skewered Taxpayers!

- “Scared to Sign Vouchers” Is Now Official GDP Policy – Welcome to the Philippines’ Permanent Paralysis Economy

- “Robbed by Restitution?” Curlee Discaya’s Tears Over Returning What He Never Earned

- “My Brother the President Is a Junkie”: A Marcos Family Reunion Special

- “Mapipilitan Akong Gawing Zero”: The Day Senator Rodante Marcoleta Confessed to Perjury on National Television and Thought We’d Clap for the Creativity

- “Bend the Law”? Cute. Marcoleta Just Bent the Constitution into a Pretzel

Leave a comment