By Louis ‘Barok‘ C. Biraogo — July 22, 2025

IN Pasig City, Mayor Vico Sotto has pulled off a fiscal miracle: saving ₱1 billion a year not by taxing the weary but by slaying the beast of corruption. His gleaming new city hall stands as a testament to governance that delivers without demanding more. Meanwhile, in Manila’s power corridors, Finance Secretary Ralph Recto floated a bold tax hike—raising capital gains, donor’s, and estate taxes from 6% to 10% to net ₱300 billion by 2030—only to backpedal under pressure, citing a 2025 revenue surge.

A viral Facebook post frames this as a clash of visions: Sotto’s anti-corruption crusade versus Recto’s fiscal fix. It’s a high-stakes drama of trust, equity, and a nation teetering on the edge of reform or ruin. Can Sotto’s model rescue the Philippines, or will systemic failures demand Recto’s tourniquet? Let’s dive into the arguments, impacts, and unanswered questions that could shape a nation’s future.

Unpacking the Clash: Sotto’s Savings vs. Recto’s Revenue Grab

Sotto’s Anti-Corruption Coup vs. Recto’s Tax Tactic

Mayor Vico Sotto’s claim of saving ₱1 billion annually in Pasig is no myth. Reports confirm that transparent procurement, digital payrolls, and relentless anti-corruption measures—think audited assets and jailed officials—have slashed waste without a single new tax. Pasig’s state-of-the-art city hall, funded entirely by these savings, is proof: good governance can build progress while sparing wallets.

The Facebook post contrasts this with Recto’s GROWTH bill, which aimed to raise ₱300 billion by 2030 by hiking capital gains, donor’s, and estate taxes to 10%. Recto argued these taxes, targeting the wealthy, would shore up fiscal health without burdening the poor, projecting ₱43 billion annually. Yet, on April 30, 2025, he scrapped the plan, buoyed by Q1 2025’s ₱931.5 billion tax haul, up 13.55% (BusinessWorld, April 30, 2025).

The post paints this as a duel: governance versus taxation. It’s a gripping narrative, but is it a false choice? Sotto’s model shows corruption bleeds budgets—World Bank estimates suggest 10–15% of the national budget vanishes to leakages. Halving that could outstrip Recto’s ₱43 billion goal. Yet, Recto’s camp insists the GROWTH bill paired taxes with e-invoicing and anti-smuggling reforms, arguing both can coexist. The post’s idealism risks oversimplifying a fiscal tightrope where structural deficits—pensions, healthcare, debt—demand more than local wins can deliver.

Is It a Smokescreen or a Systemic Slam?

The post’s critique of systemic rot hits hard. Pasig’s digitized bidding and payrolls expose “Standard Operating Procedure” (SOP)—code for graft—siphoning billions. National scandals, like the ₱10 billion Pharmally scam (Rappler, 2021) and BI’s “pastillas” bribery (Philippine Star, 2020), fuel distrust that new taxes will feed corrupt coffers.

Sotto’s success, backed by U.S. State Department recognition, is a beacon: governance can reclaim stolen pesos. But it stumbles on scale: Pasig’s ₱1 billion, while a triumph for 800,000 residents, is a drop against the national ₱1.2 trillion debt service in 2025 (DBM, 2025). The post’s governance-or-taxes binary glosses over the need for both to avert fiscal collapse.

Equity on the Line: Who Wins, Who Loses?

The Poor: Caught Between Burden and Boon

Recto’s tax hike, had it survived, would have hit wealthier Filipinos—capital gains and estate taxes target property owners and investors, not jeepney drivers. But the real estate industry, led by CREBA, warned of collateral damage: higher transaction costs could spike housing prices, crushing affordability for low-income buyers (Philippine Star, April 26, 2025). Informal labor markets, tied to construction jobs, could falter if investment slowed, a gut punch to the poor.

Sotto’s model, conversely, shields low-income residents by funding services—healthcare, schools—without new taxes, ensuring every peso saved is a child’s meal not missed. Pasig’s programs, like rewarding honest employees to deter bribery (Pasig City Programs), prioritize the vulnerable by maximizing service delivery.

Trust in Government: Transparency’s Triumph or Scandal’s Shadow?

Sotto’s Pasig has rebuilt faith through visible wins: open bidding, digital disbursements, and corrupt officials behind bars (U.S. State Department, 2021). These stand in stark contrast to national scandals—Pharmally’s ghost deliveries, PDAF’s plundered billions (Philippine Star, 2013).

Recto’s tax hike, proposed amid such distrust, sparked backlash from CREBA and middle-class voters fearing they’d pay while loopholes persisted (BitPinas, April 24, 2025). The post’s viral surge on X, with users like @teta_limcangco lauding Sotto and @mr_90two10 slamming Recto (X, July 19, 2025), reflects a public yearning for leaders who prove taxes won’t fuel corruption. Sotto’s transparency is a vaccine against distrust; Recto’s retreat signals the disease lingers.

The Great Retreat: Why Recto Folded and What It Means

Why Did Recto Blink?

Recto’s April 30, 2025, withdrawal came as Q1 tax collections roared to ₱931.5 billion, up 13.55%, with BIR’s ₱690.4 billion (16.67% growth) and Customs’ ₱231.4 billion (5.72% growth) signaling fiscal strength (BusinessWorld, April 30, 2025). But is this a lasting victory?

The Philippines’ tax-to-GDP ratio, at 14.1%, trails ASEAN peers like Thailand (17%) and Vietnam (18%) (World Bank, 2024). Debt servicing eats 20% of the 2025 budget (DBM, 2025), and climate disasters plus pension liabilities loom, with spending needs projected to rise 2% of GDP by 2030 (ADB, 2024). Recto’s retreat may be a fleeting reprieve, not a cure.

Can Sotto’s Magic Scale Nationwide?

Pasig’s playbook—digitized systems, transparent procurement—is a model, but national scaling is no slam dunk. Local governments control operating budgets; national deficits stem from structural beasts like pensions (₱260 billion/year) and debt amortization (DBM, 2025). Rolling out Sotto’s model in agencies like DPWH or DOH could save billions, but entrenched interests and bureaucratic sludge pose formidable barriers. The post’s optimism assumes Sotto’s leadership is replicable, yet few LGUs match Pasig’s political will or resources.

Burning Questions: What’s Left Unsaid?

Corruption vs. Cash: Can Governance Alone Bridge the Abyss?

The post’s idealism—that good governance negates tax hikes—collides with fiscal reality. The ₱1.2 trillion debt service gap (DBM, 2025) towers over Pasig’s ₱1 billion. Even if every LGU matched Sotto’s savings, the total wouldn’t cover national needs. Corruption siphons 10–15% of the budget (World Bank, 2022), but structural deficits—pensions, healthcare, climate resilience—demand revenue beyond efficiency’s reach. The post sidesteps this, framing taxes as surrender to corruption rather than a parallel necessity.

Why Sotto Soars While Recto Sinks

Sotto’s reforms dazzle because they’re tangible—new schools, a futuristic city hall, no new taxes. His anti-corruption arrests and U.S. recognition fuel viral X support (@mr_90two10). Recto’s plan, targeting wealth, alienated CREBA and middle-class voters fearing higher costs without clear benefits (BitPinas, April 24, 2025). Distrust, stoked by scandals, made his proposal a lightning rod, while Sotto’s visible wins insulated him. Filipinos trust doers, not dreamers of future gains.

A Roadmap to Redemption: Blending Sotto’s Vision with Fiscal Courage

To navigate this fiscal high-wire act, the Philippines needs a bold fusion of Sotto’s vaccine and a smarter version of Recto’s tourniquet:

- Scale the Pasig Playbook: Mandate digitized bidding and payrolls across LGUs and national agencies, replicating Pasig’s proven model. A national anti-corruption task force, inspired by Sotto’s Efficiency and Anti-Corruption Commission (Wikipedia), could enforce accountability.

- Smart Wealth Taxes: Embrace Rep. Salceda’s idea of taxing luxury goods (Philippine Star, 2025), hitting the ultra-rich without sparking capital flight. These are less distortionary than broad tax hikes and align with equity.

- Rebuild Trust with Earmarks: Tie new taxes to visible anti-poverty programs, like 4Ps expansion or climate-resilient housing. Public dashboards tracking funds can counter distrust from scandals.

- Brace for Impact: Recto’s retreat buys time, but climate shocks and aging demographics demand reform. A national fiscal summit, uniting LGUs, could merge Sotto’s grassroots wins with Recto’s macro vision.

The Final Question: Saviors or Systems?

Every peso saved from corruption is a child’s meal secured, a flood victim saved. But every peso lost to fiscal delay is a future squandered. Pasig’s triumph lights the way, yet the nation’s coffers groan under debt and distrust. When the next crisis strikes—typhoon or deficit—will the Philippines be lifted by its Sottos, or drowned by its systems?

Key Citations

- Facebook Post. [URL: https://www.facebook.com/share/p/19aD26dJgG/%5D Accessed [July 19, 2025].

- Philippine Daily Inquirer, October 16, 2024: Pasig’s ₱1 billion annual savings and new city hall.

- BusinessWorld, April 30, 2025: Recto’s tax hike withdrawal and Q1 2025 tax collections.

- BitPinas, April 24, 2025: Details of Recto’s GROWTH bill and CREBA’s warnings.

- World Bank, 2022: Budget leakage estimates of 10–15%.

- Rappler, 2021: Pharmally scandal details.

- Philippine Star, 2020: BI “pastillas” bribery scheme.

- U.S. State Department, 2021: Sotto’s transparency award.

- DBM, 2025: National budget and debt service figures.

- ADB, 2024: Future spending needs projection.

- Pasig City Programs: Anti-corruption and employee reward initiatives.

- X, July 19, 2025: Public sentiment on Sotto vs. Recto.

- Wikipedia: Sotto’s Efficiency and Anti-Corruption Commission.

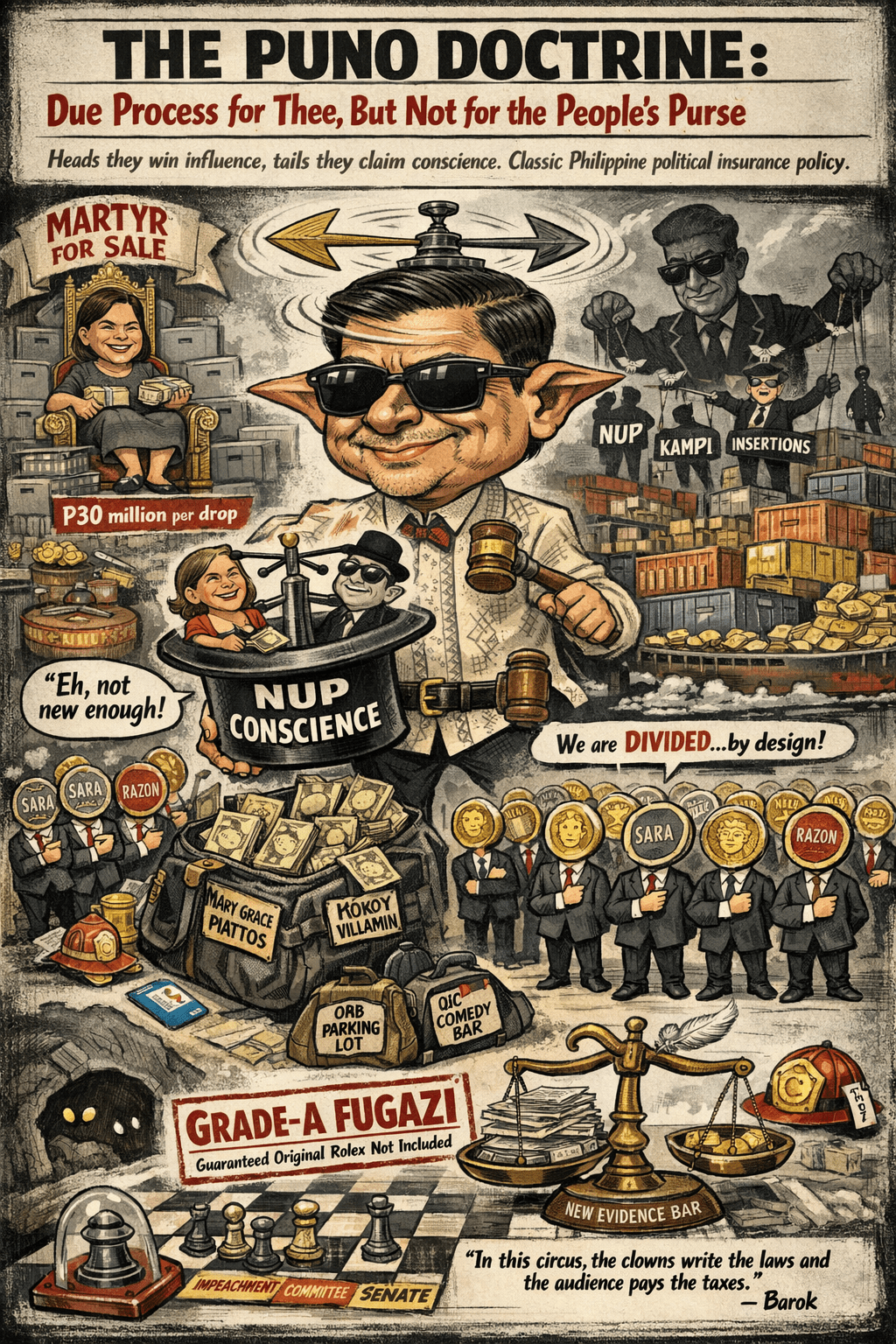

- “Forthwith” to Farce: How the Senate is Killing Impeachment—And Why Enrile’s Right (Even If You Can’t Trust Him)

- “HINDI AKO NAG-RESIGN!”

- “I’m calling you from my new Globe SIM. Send load!”

- “Mahiya Naman Kayo!” Marcos’ Anti-Corruption Vow Faces a Flood of Doubt

- “Meow, I’m calling you from my new Globe SIM!”

- “No Special Jail for Crooks!” Boying Remulla Slams VIP Perks for Flood Scammers

- “PLUNDER IS OVERRATED”? TRY AGAIN — IT’S A CALCULATED KILL SHOT

- “Several Lifetimes,” Said Fajardo — Translation: “I’m Not Spending Even One More Day on This Circus”

- “Shimenet”: The Term That Broke the Internet and the Budget

- “We Did Not Yield”: Marcos’s Stand and the Soul of Filipino Sovereignty

- “We Gather Light to Scatter”: A Tribute to Edgardo Bautista Espiritu

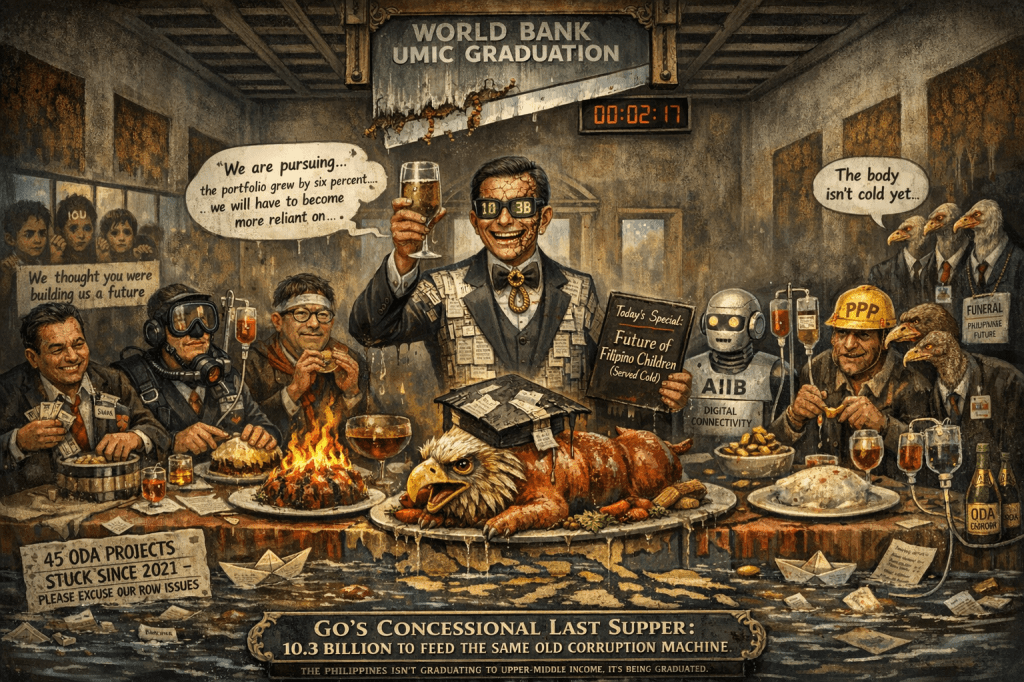

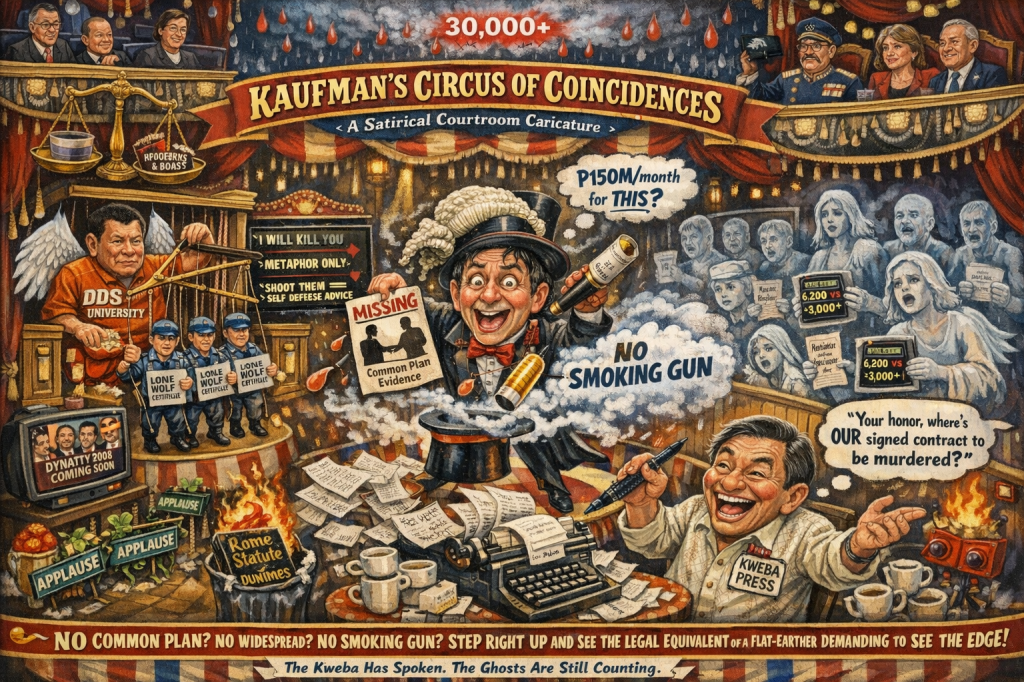

- $150M for Kaufman to Spin a Sinking Narrative

Leave a comment