By Louis ‘Barok‘ C Biraogo — August 24, 2025

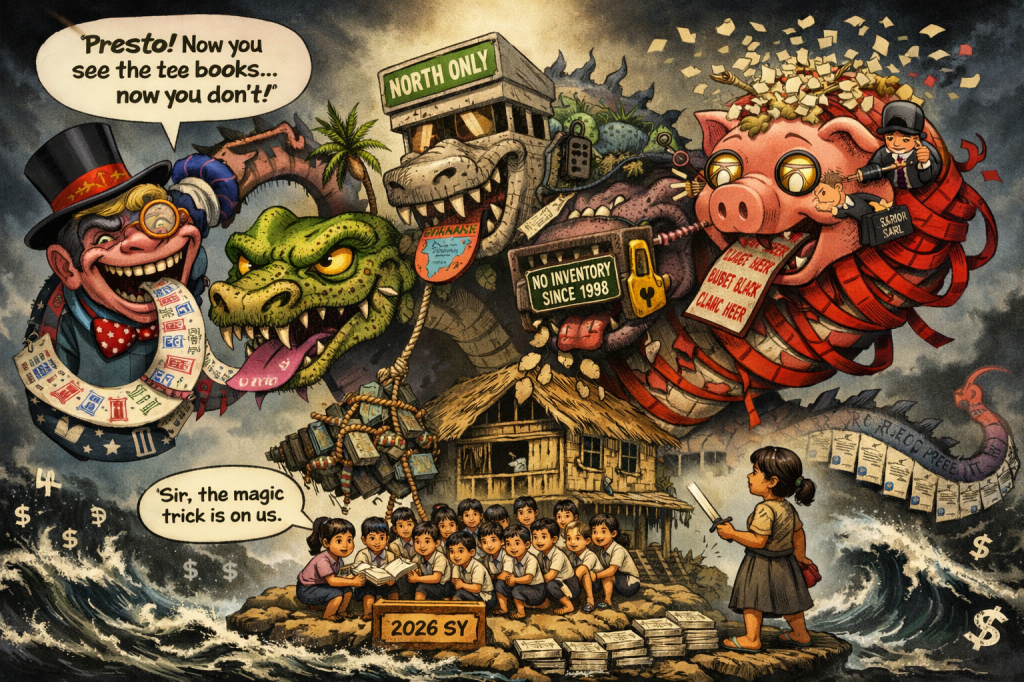

OH, look, another day in the Philippine corporate circus, where the Villar family—real estate titans, political overlords, and accounting alchemists—treats the public market like their personal slot machine. The Securities and Exchange Commission (SEC) has finally noticed, slapping Villar Land Holdings Corp. and its dynastic board—Manny, Senators Mark and Camille, and brother Paolo—with a laughable ₱12 million fine for flouting reporting rules and dropping a March 2025 disclosure so misleading it could star in a scam documentary.

Buckle up for a Kweba ng Katarungan takedown, dripping with sarcasm and legal precision, as we shred the Villars’ excuses, expose the SEC’s spinelessness, and reveal how this saga is a middle finger to every Filipino hoping for a fair market. Spoiler: it’s not just late paperwork—it’s a dynasty looting the system while regulators nap.

The Villars’ Laughable Defense: Excuses Thinner Than Their Public Float

The Villars’ defense is a masterclass in corporate fiction, served with a side of crocodile tears. They claim “audit complexity” and “good faith” absolve their sins. Spoiler: they don’t.

Audit Complexity? Try Accounting Voodoo

The Villars whine that their 2024 acquisition of 366 hectares for Villar City and a switch to fair-value accounting turned their audit into a Gordian knot. Poor Punongbayan & Araullo (P&A) just couldn’t cope, they say, needing more time to justify a ₱1.33 trillion valuation on land bought for ₱5.2 billion.

The SEC, generous as it was, extended deadlines to June 30, 2025, per Section 17.2 of the Securities Regulation Code (SRC), only to get crickets. The Supreme Court in SEC v. Interport Resources Corp. (G.R. No. 135808, 2008) laughed off “complexity” as an excuse for missing statutory deadlines. With their resources, the Villars’ failure is either gross incompetence or a deliberate stall to keep their trillion-peso mirage alive.

Good Faith? More Like Bad Faith on Steroids

Then there’s the “good faith” defense for their March 28, 2025, disclosure, which trumpeted ₱1.33 trillion in fair-value gains and “approved” financials—never mind the audit wasn’t done. This triggered a trading spike from ₱218,000 to ₱2.11 million daily, per the SEC’s order.

They claim no intent to mislead, but SRC Section 24.1(d) bans “false, misleading, or incomplete statements,” and calling unaudited numbers “approved” is fraud in a suit. The Supreme Court in Union Bank of the Philippines vs. Securities and Exchange Commission (G.R. No. 138949, June 6, 2001) ruled that incomplete disclosures tank market trust, intent be damned. The Villars’ “whoopsie” is as believable as a politician promising tax cuts.

The SEC’s Feeble Flick: A Fine That’s Barely a Flea Bite

The SEC’s response—a ₱12 million fine for a company claiming ₱1.37 trillion in assets—is like fining a billionaire for jaywalking. The order cites violations of SRC Section 54.1(c) for misleading statements, Section 26.3 for fraudulent acts, and Sections 30 and 158 of the Revised Corporation Code (RCC) for gross negligence and director liability. Solid legal footing, but the penalty is a joke.

A History of Regulatory Napping

The SEC’s track record is a parade of limp enforcement. From the 1999 BW Resources scandal to the MFT Group’s shenanigans, it’s been more lapdog than watchdog. Interport gave the SEC teeth to punish disclosure violations, yet it opts for a fine that’s 0.0009% of Villar Land’s claimed worth.

Suspension of trading—already done by the PSE in May 2025—or revoking registration were options, but the SEC chose a “show cause” order, akin to asking a fox why the henhouse is empty. Criminal charges under SRC Section 72 (up to 21 years in prison) or insider trading probes under Section 27 are nowhere in sight. Why? Perhaps because taking on a family with two senators and a former Senate President is like wrestling a crocodile with a pool noodle.

Protecting Shareholders or Protecting Power?

The SEC claims it spared suspension to avoid harming minority shareholders, per its order. Noble, but hollow when the Villars’ disclosure already misled investors, with shares frozen at ₱2,296 post-spike. If the SEC were serious, it’d be digging for insider trading or wielding Section 5(i) to appoint a monitor. Instead, it’s playing nice, likely wary of the Villars’ political clout.

The Villar Empire: A Dynasty of Greed in Gucci Loafers

This isn’t just about late filings—it’s about a business model that screams dynastic privilege.

Fair-Value Fraud: Turning Dirt into Diamonds

Villar Land’s ₱1.33 trillion “gain” came from revaluing 366 hectares from ₱5.2 billion to ₱1.3 trillion, courtesy of appraiser E-Value Phils. Fair-value accounting under PFRS 13 Fair Value Measurement is legal, but a 250x markup rejected by P&A smells like a scheme to inflate balance sheets for loans or bragging rights. This isn’t business savvy; it’s Enron with better PR.

Public Float? More Like Family Fortress

The Villars’ empire—Villar Land, Vista Land, AllHome—keeps public floats at the PSE’s bare minimum (10-20%), ensuring family control while minority shareholders get table scraps. This violates the spirit of market fairness, letting insiders manipulate prices with ease.

Senators as Corporate Cronies

Mark and Camille Villar, sitting senators, double as Villar Land directors, a screaming conflict under RA 6713’s Section 7 banning public officials from holding conflicting interests. Mark’s public works committee chairmanship and Camille’s environment role could sway policies favoring their empire. The Supreme Court in Pimentel Jr. v. Executive Secretary (G.R. No. 158088, 2005) condemned self-dealing, yet the Villars waltz between Senate and boardroom like it’s a family reunion.

This ties to the Philippines’ dirty secret: dynasties. Article II, Section 26 of the Constitution bans political dynasties, but without an enabling law, it’s a hollow promise. The Villars’ grip on Las Piñas and the Senate is feudalism in modern drag.

The Fallout: A Rigged Game for Filipinos

This saga is a gut punch to market integrity. Retail investors, burned by misleading disclosures, will shun the PSE, starving the economy of capital. Foreign investors, eyeing the Philippines’ shaky regulatory reputation, will bolt. The Villars’ land overvaluations could inflate housing prices, screwing ordinary Filipinos already priced out of Metro Manila.

The irony is sickening: senators potentially liable under RCC Section 158 for gross negligence are crafting laws that could shield their empire. This erodes public trust, fuels inequality, and cements a feudal economy where dynasties rule.

Fixing the Fiasco: Time for Real Consequences

Enough whining—here’s the fix:

- SEC, Grow a Backbone. Suspend Villar Land’s registration until audited financials are filed, per SRC Section 54.1. Probe insider trading under Section 27 and pursue criminal charges under Section 72. Appoint a monitor under Section 5(i).

- Senators, Get Out. Mark and Camille must resign from Villar Land’s board. Their dual roles violate RA 6713. The Ombudsman should probe for Anti-Graft Law (RA 3019) violations.

- PSE, Stop Enabling. Mandate a 30% public float to dilute family control. The current 10-20% rule is a dynastic loophole.

- Pass the Anti-Dynasty Law. Congress must enact the enabling law for Article II, Section 26. The Villars are why.

- Audit the Enablers. Investigate E-Value Phils for its ₱1.3 trillion valuation. If it’s complicit, revoke its accreditation under SRC Section 16.

The Verdict: A Dynasty Above the Law

The Villar Land fiasco isn’t a clerical error—it’s a symptom of a rotten system where dynasties play fast and loose with markets and democracy. The SEC’s ₱12 million fine is a pathetic gesture, and the Villars’ excuses are a slap in the face. This is a test of whether Philippine institutions can tame the oligarchs or keep kissing their rings.

For investors, democracy, and every Filipino dreaming of fairness, let’s hope the SEC grows a spine before the Villars turn the PSE into their personal casino. Until then, the dynasty laughs, and the house always wins.

Key Citations

- Securities Regulation Code (RA 8799): Sections 17.2, 24.1(d), 26.3, 27, 54.1(c), 72.

- Revised Corporation Code (RA 11232): Sections 30, 158.

- Code of Conduct for Public Officials (RA 6713): Section 7.

- Anti-Graft and Corrupt Practices Act (RA 3019).

- Philippine Constitution, Article II, Section 26.

- SEC v. Interport Resources Corp. (G.R. No. 135808, 2008).

- Union Bank of the Philippines vs. Securities and Exchange. Commission (G.R. No. 138949, June 6, 2001)

- Pimentel Jr. v. Executive Secretary (G.R. No. 158088, 2005).

- PFRS 13: Fair Value Measurement.

- SEC Order on Villar Land.

- ₱75 Million Heist: Cops Gone Full Bandit

- ₱6.7-Trillion Temptation: The Great Pork Zombie Revival and the “Collegial” Vote-Buying Circus

- ₱1.9 Billion for 382 Units and a Rooftop Pool: Poverty Solved, Next Problem Please

- ₱1.35 Trillion for Education: Bigger Budget, Same Old Thieves’ Banquet

- ₱1 Billion Congressional Seat? Sorry, Sold Out Na Raw — Si Bello Raw Ang Hindi Bumili

- “We Will Take Care of It”: Bersamin’s P52-Billion Love Letter to Corruption

- “Skewed Narrative”? More Like Skewered Taxpayers!

- “Scared to Sign Vouchers” Is Now Official GDP Policy – Welcome to the Philippines’ Permanent Paralysis Economy

- “Robbed by Restitution?” Curlee Discaya’s Tears Over Returning What He Never Earned

- “My Brother the President Is a Junkie”: A Marcos Family Reunion Special

- “Mapipilitan Akong Gawing Zero”: The Day Senator Rodante Marcoleta Confessed to Perjury on National Television and Thought We’d Clap for the Creativity

- “Bend the Law”? Cute. Marcoleta Just Bent the Constitution into a Pretzel

Leave a comment