By Louis ‘Barok‘ C. Biraogo — March 3, 2025

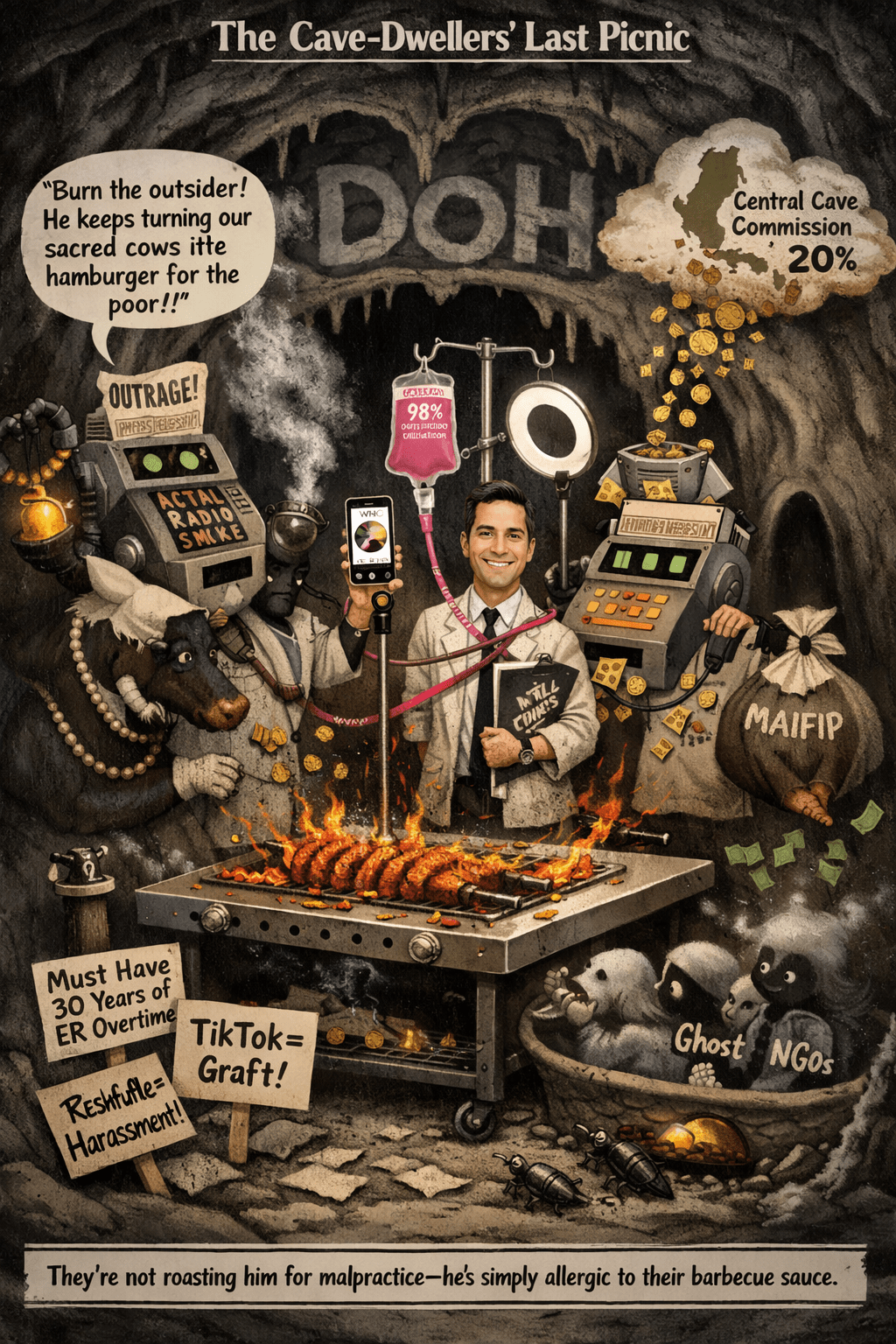

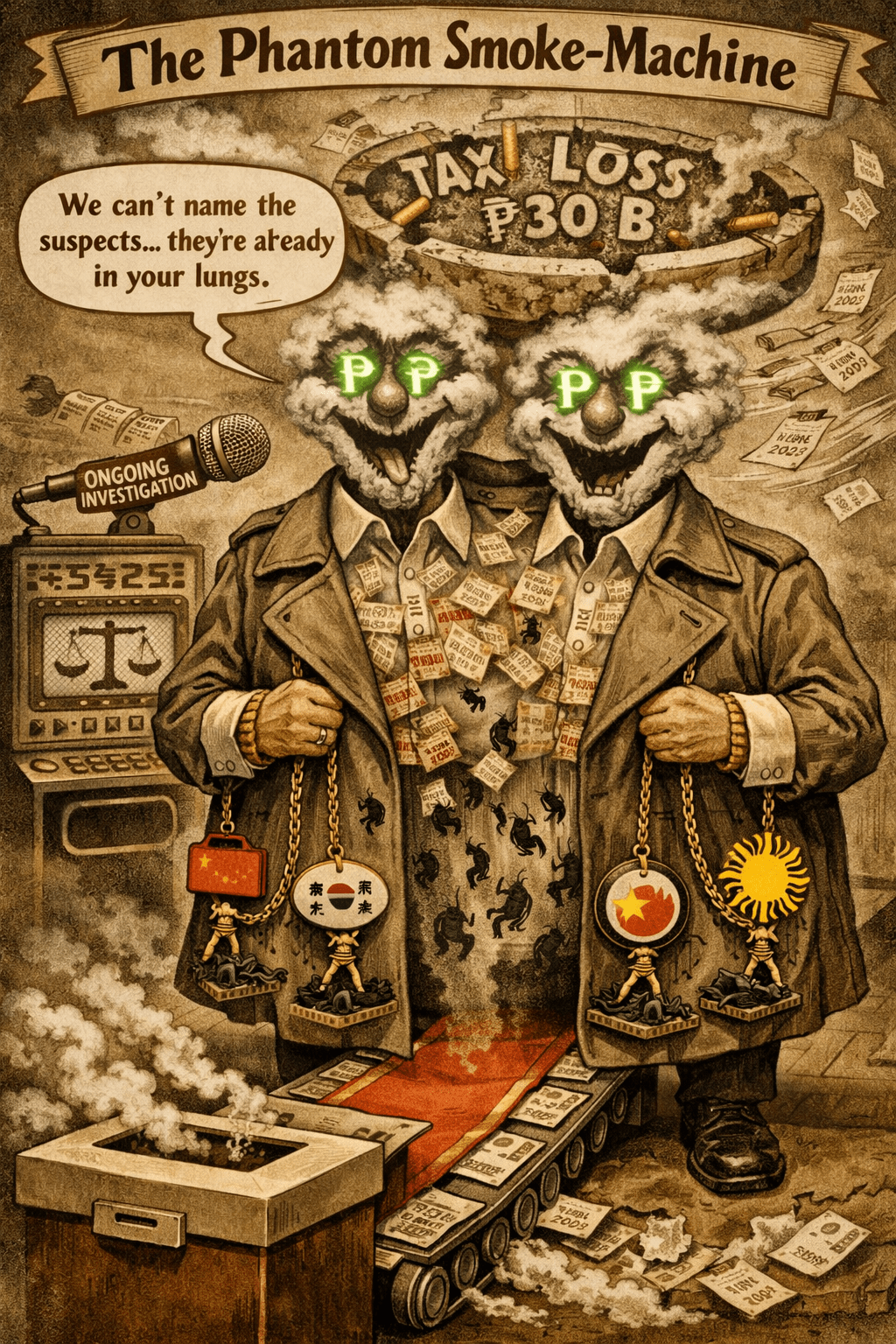

₱176 MILLION in alleged tax evasion. Fictitious ‘ghost receipts’ from non-existent companies. Hilmarc’s Construction Corporation, a titan of Philippine government contracts, now faces a seismic legal battle with the Department of Justice (DOJ) and Justice Secretary Jesus Crispin C. Remulla. This AAA-rated contractor, once synonymous with prestige, is embroiled in a scandal that could redefine corporate accountability in the Philippines. What does this case mean for tax compliance, fraud enforcement, and the future of government contracting? Let’s dissect the allegations, legal strategies, and far-reaching implications of this high-stakes prosecution.

STATUTORY FRAMEWORK: Decoding the Tax Code’s Heavy Artillery

The DOJ’s case hinges on Sections 254 and 255 of the National Internal Revenue Code (NIRC) of 1997, as amended — the twin pillars of criminal tax enforcement in the Philippines. Here’s the legal scaffolding:

Section 254: Attempt to Evade or Defeat Tax

Section 254 is the Tax Code’s big gun, targeting “any person who willfully attempts in any manner to evade or defeat any tax imposed under this Code.” Penalties include fines ranging from ₱30,000 to ₱100,000 and imprisonment from two to four years. The BIR’s implementing rules (e.g., Revenue Regulations No. 12-99) flesh this out, emphasizing willful acts like falsifying records or underreporting income.

- Elements to Prove:

- Tax Deficiency: A shortfall in tax payment must exist.

- Affirmative Act: The taxpayer must actively do something — think fake receipts or cooked books — to dodge the tax.

- Willfulness: The act must be intentional, not accidental, with knowledge of legal duty.

Section 255: Failure to Supply Correct Information

Section 255 is the precision strike, punishing “any person required under this Code… to pay any tax, make a return, [or] supply correct and accurate information” who “willfully fails” to do so. Penalties here are steeper: fines of at least ₱10,000 and jail time from one to ten years.

- Elements to Prove:

- Legal Duty: The taxpayer has a statutory obligation (e.g., filing accurate returns).

- Failure: That duty wasn’t met — here, allegedly via bogus deductions.

- Willfulness: Again, intent is king; negligence won’t cut it.

Criminal vs. Civil Liability: The Fork in the Road

Philippine tax law splits liability into two lanes. Criminal tax evasion (Sections 254, 255) requires intent and carries jail time, prosecuted by the DOJ with BIR backing. Civil liability, under Section 204, is about collecting unpaid taxes, penalties, and interest — no intent needed, just a deficiency. Hilmarc’s faces both: a ₱176.36 million civil bill alongside criminal charges. The Supreme Court has clarified (e.g., Ungab v. Cusi, G.R. No. L-41919-21, 1980) that these can run concurrently — a criminal conviction doesn’t bar civil recovery, and vice versa. It’s a double-barreled approach that maximizes the government’s leverage.

CASE ASSESSMENT: Ghost Receipts Under the Microscope

The “Ghost Receipts” Allegation

The DOJ claims Hilmarc’s used receipts from Unimaker Enterprises Inc. and Everpacific Incorporated — allegedly fictitious entities — to claim deductions and input tax credits, slashing its tax bill by ₱176 million. In Philippine tax fraud lore, “ghost receipts” are the stuff of legend: fake invoices to inflate expenses or VAT credits, a scheme the BIR’s Run After Fake Transactions (RAFT) program has been hunting since 2023. Jurisprudence, like CIR v. Gonzales (G.R. No. 196118, 2015), treats these as textbook affirmative acts under Section 254 if proven fictitious and intentional.

The ₱176M Price Tag and Sentencing

That ₱176 million figure isn’t just a headline grabber — it’s a sentencing multiplier. Under the Revised Penal Code (RPC), penalties for economic crimes scale with the amount involved. For Section 254, the two-to-four-year range could lean toward the max if the court pegs this as “large-scale” fraud. Section 255’s one-to-ten-year span gives judges more room, and ₱176 million — plus alleged “billions” in broader losses — could push sentences upward, especially with multiple counts (eight charges here). Fines, though capped, add sting, and civil penalties (50% surcharge, 20% interest) pile on the pain.

Jurisdiction: CTA vs. Regular Courts

The CTA’s role is key. Republic Act No. 9282 expanded its jurisdiction to include criminal tax cases, making it the go-to venue for Sections 254 and 255 violations. Regular courts only step in for unrelated crimes (e.g., falsification under the RPC). Here, the CTA’s specialized tax expertise gives it the edge, though Hilmarc’s could challenge jurisdiction if procedural missteps (e.g., no BIR assessment) surface. The Supreme Court (CIR v. La Suerte, G.R. No. 165891, 2010) has upheld CTA primacy in tax prosecutions, so this filing looks solid.

PRECEDENT ANALYSIS: Supreme Court Scorecard

1. Evidentiary Requirements: CIR v. Gonzales (G.R. No. 196118, 2015)

- Ruling: The Court demanded hard proof — not just suspicion — of falsified records to sustain a Section 254 conviction. BIR allegations of underreported income fell flat without receipts or third-party corroboration.

- Hilmarc’s Takeaway: The DOJ must produce ironclad evidence that Unimaker and Everpacific are phantoms — think incorporation records, physical addresses, or witness testimony. Weak links could unravel the case.

2. Willfulness in Corporate Fraud: People v. Mendez (G.R. No. 208411, 2016)

- Ruling: Willfulness means a “voluntary, intentional violation of a known legal duty.” A doctor-businessman’s failure to file returns was willful given his education and resources.

- Hilmarc’s Lens: For a corporation, willfulness hinges on officers’ actions. If Efren Canlas & Co. knowingly signed off on ghost receipts, they’re in the crosshairs. Proving intent across a corporate veil is trickier, though.

3. Corporate Officer Liability: Suarez v. People (G.R. No. 235326, 2021)

- Ruling: The Court acquitted an executive VP not listed in Section 253(d) (partners, presidents, etc.) absent proof she was the “employee responsible” for the violation. A letter to the BIR wasn’t enough.

- Hilmarc’s Angle: Section 253(d) tags officers like presidents (Efren Canlas?) but spares underlings unless directly culpable. Cristina and Robert’s roles will be pivotal — were they puppets or masterminds?

Comparison to Past Cases

- Success: People v. Ressa (CTA, 2020, reversed 2023) — Rappler’s tax evasion case initially stuck due to alleged unreported PDR income, but the CTA acquittal showed shaky evidence can tank even high-profile prosecutions.

- Flop: CIR v. Berboso (G.R. No. 152104, 2005) — The BIR lost when it couldn’t prove intent behind alleged fake receipts, a cautionary tale for Hilmarc’s prosecutors.

Hilmarc’s sits between these poles: a big fish with a big number, but the evidentiary bar is high.

DEFENSE STRATEGIES: Hilmarc’s Playbook

Substantive Defenses

- No Willfulness: Argue the receipts were clerical errors or third-party fraud (Unimaker/Everpacific’s doing), not Hilmarc’s intent. Precedent (Mendez) demands clear proof of knowledge.

- Legitimate Transactions: Produce contracts, delivery records, or payments to show the deals were real. If the entities exist, the “ghost” label collapses.

- Good Faith: Lean on reliance on accountants or tax pros (CIR v. La Suerte), shifting blame and negating intent.

Procedural Defenses

- No Assessment: Push that criminal charges need a final BIR assessment (Ungab), though Berboso says otherwise — a long shot worth testing.

- Due Process: Challenge BIR’s RAFT probe for bias or inadequate notice, fishing for dismissal.

Settlement Options

Under Revenue Memorandum Order No. 7-2015, Hilmarc’s could negotiate a compromise with the BIR, paying a reduced civil liability (e.g., 40% of ₱176M) to dodge criminal prosecution. It’s a pragmatic out, especially if evidence looks damning.

Corporate Structure and Officer Liability

Hilmarc’s AAA status suggests a complex hierarchy. Section 253(d) limits liability to enumerated officers or those “responsible” for the violation (Suarez). If Efren’s the president, he’s exposed; Cristina and Robert might argue they’re not decision-makers, diluting personal risk. Piercing the corporate veil is rare absent fraud proof, so the company itself may bear the brunt.

POLICY IMPLICATIONS: Bigger Than Hilmarc’s

Enforcement Priorities

This case screams RAFT’s mission: stamp out ghost receipt syndicates. The BIR’s 2023 filings (e.g., ₱1.8B vs. 69 respondents) show a pattern — big players, big losses, big headlines. Targeting a Top 1000 firm like Hilmarc’s signals no one’s untouchable.

Government Contractors

Hilmarc’s government gigs (Makati City Hall, Senate building) put procurement under scrutiny. Expect tighter tax compliance checks in bidding rules — a headache for contractors but a win for transparency.

Recommendations

- Policy Reform: Codify RAFT’s ghost receipt criteria into law for clarity; streamline CTA jurisdiction to fast-track cases.

- Defense Counsel: Dig into Unimaker/Everpacific’s paper trail — existence kills the case. Push settlement early if evidence wobbles.

Conclusion: A Test Case for Tax Justice

Hilmarc’s Construction is in the DOJ’s crosshairs, facing a ₱176 million reckoning that could redefine tax enforcement in the Philippines. The statutory framework is clear, but proof — especially willfulness — is the wild card. Precedents demand rigor from prosecutors, while defenses have room to maneuver. For practitioners, this is a wake-up call: shore up compliance or face the CTA’s gavel. For lawmakers, it’s time to tighten procurement and tax loopholes. Hilmarc’s fate? It’s a coin toss — but the ripple effects will hit hard either way.

- “Forthwith” to Farce: How the Senate is Killing Impeachment—And Why Enrile’s Right (Even If You Can’t Trust Him)

- “HINDI AKO NAG-RESIGN!”

- “I’m calling you from my new Globe SIM. Send load!”

- “Mahiya Naman Kayo!” Marcos’ Anti-Corruption Vow Faces a Flood of Doubt

- “Meow, I’m calling you from my new Globe SIM!”

- “PLUNDER IS OVERRATED”? TRY AGAIN — IT’S A CALCULATED KILL SHOT

- “Several Lifetimes,” Said Fajardo — Translation: “I’m Not Spending Even One More Day on This Circus”

- “Shimenet”: The Term That Broke the Internet and the Budget

- “We Did Not Yield”: Marcos’s Stand and the Soul of Filipino Sovereignty

- “We Gather Light to Scatter”: A Tribute to Edgardo Bautista Espiritu

- $150M for Kaufman to Spin a Sinking Narrative

- $2 Trillion by 2050? Manila’s Economic Fantasy Flimsier Than a Taho Cup

Leave a comment