When “Fair Value” Means “Whatever Number Keeps the Stock Pumped Until We Cash Out”

By Louis “Barok” C. Biraogo — February 1, 2026

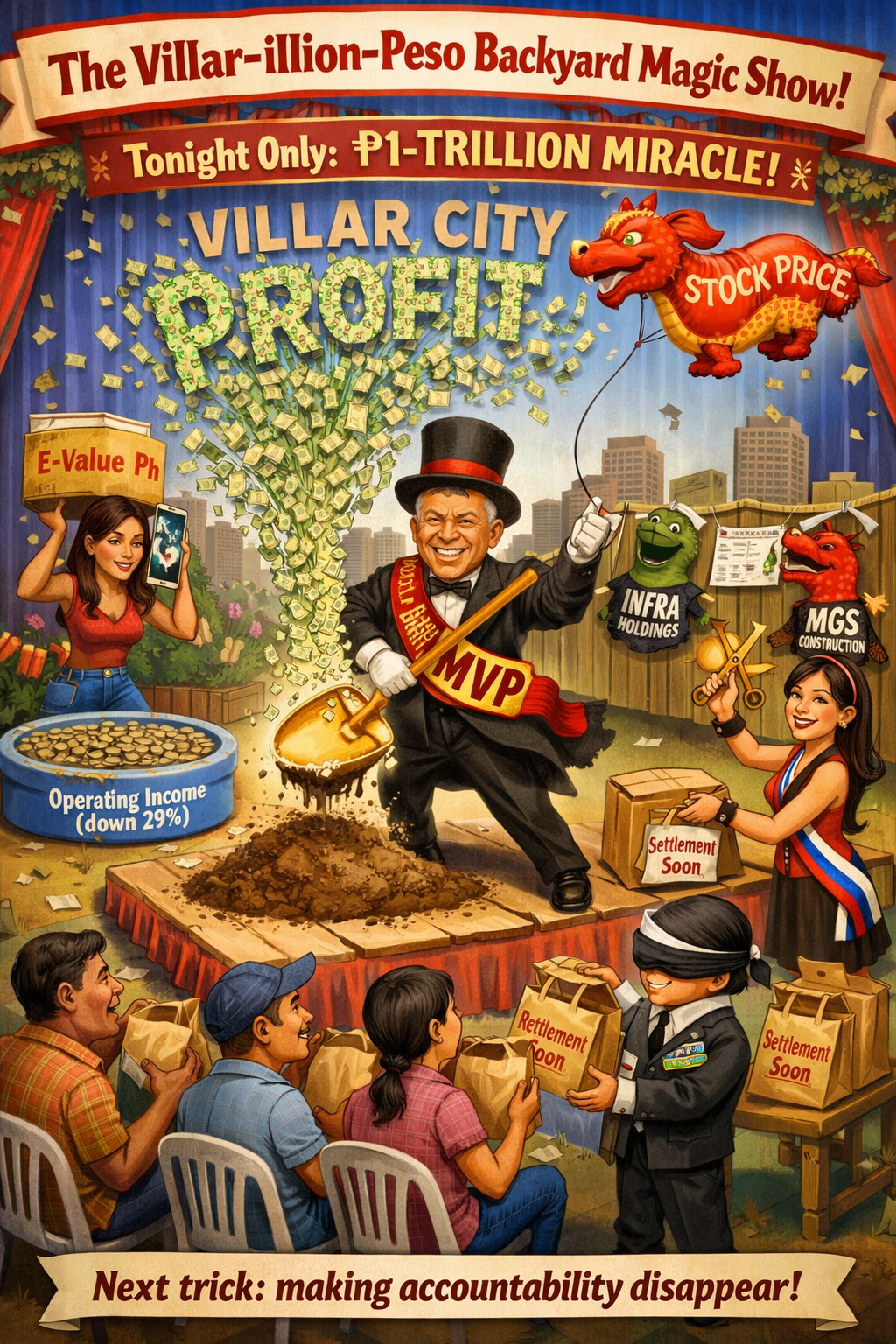

THE Securities and Exchange Commission (SEC) has filed a criminal complaint against Villar Land Holdings Corporation (VLC)—formerly Golden MV Holdings—and key members of the Villar family. The charges include market manipulation, insider trading, and dissemination of materially misleading disclosures. This case exposes the core mechanics of dynastic capitalism in the Philippines, where political influence, family enterprises, and public markets dangerously intersect.

As detailed in a recent Rappler report, the complaint stems from VLC’s staggering P1 trillion profit claim in 2024, largely driven by questionable fair value gains on intra-family land transfers.

The Grand Narrative: A System Built for the Few

This is not an isolated incident. It is the predictable outcome of a market where family conglomerates leverage political power to inflate valuations. Land moves between Villar-controlled entities—Althorp Land Holdings, Chalgrove Properties, and Los Valores Corporation—emerges revalued at astronomical levels, and suddenly yields nearly P1 trillion in “profit.” Without these gains, VLC’s operating profit actually declined 29% to P1.22 billion.

Fair value accounting under Philippine Financial Reporting Standards (PFRS) permits such revaluations, but when the buyer, seller, and appraiser are all connected, the process invites abuse. This is self-dealing elevated to an art form.

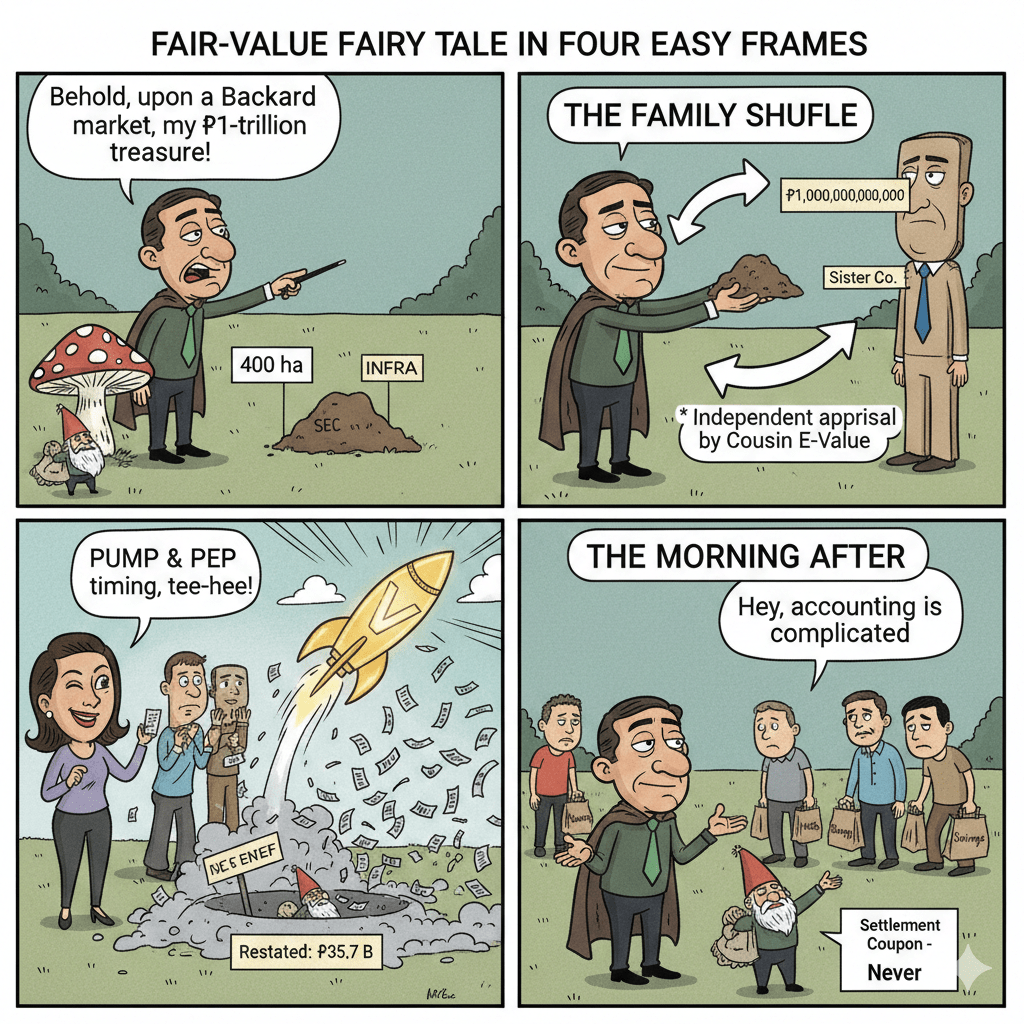

How the Illusion Was Crafted

The Fair Value Mechanism

VLC acquired nearly 400 hectares within Villar City from sister companies. An independent appraiser, E-Value Philippines, provided the elevated valuations. External auditor Punongbayan & Araullo later withheld approval, forcing restatement and revealing assets at only P35.7 billion—far below the boasted figures. Premature disclosure of unaudited numbers fueled market excitement before reality intruded.

Insider Trading Allegations

Senator Camille Villar purchased 73,600 shares worth P1.43 million in December 2017, mere hours before a favorable disclosure. Such timing raises serious questions under prohibitions against trading on material non-public information.

Artificial Market Support

Entities like INFRA Holdings and MGS Construction executed trades that appeared to create false demand, a practice known as “painting the tape.” This artificially propped up VLC’s share price, misleading ordinary investors.

The Legal Framework: Strong on Paper, Weak in Practice

The Securities Regulation Code (Republic Act No. 8799) provides clear prohibitions:

- Section 24 bars manipulation of security prices and false appearances of active trading.

- Section 27 prohibits insider trading.

- Section 26 penalizes fraudulent use of material non-public information.

Penalties can reach 21 years’ imprisonment and substantial fines. Yet enforcement against major conglomerates remains rare. Cases often end in modest settlements or prolonged delays rather than accountability.

For public officials like Senators Mark and Camille Villar, the Code of Conduct and Ethical Standards for Public Officials and Employees (Republic Act No. 6713) requires divestment in cases of conflict. The persistence of family-named enterprises suggests this requirement is more honored in the breach.

The Philippine Stock Exchange (PSE) suspended VLC trading only after the controversy erupted, highlighting reactive rather than preventive oversight.

Likely Defenses and Outcomes

VLC and the respondents will likely cite good faith, reliance on professional appraisers, and technical complexity. They may portray the case as politically motivated. Historical precedent suggests a negotiated settlement—a fine treated as a business expense—rather than full prosecution.

A Call for Genuine Reform

This scandal tests the integrity of Philippine capital markets. Without action, it confirms that rules apply unevenly.

Needed reforms include:

- Independent special prosecution for high-profile securities cases.

- Stricter rules on related-party fair value gains.

- Reversed burden of proof for politically exposed persons in insider trading probes.

- Enhanced real-time trade surveillance.

The Villar Land case is more than alleged manipulation. It is a referendum on whether our markets serve the many or remain a playground for the powerful few.

We are failing that test—unless we demand better.

Yours in perpetual disgust at the rule of law being treated like a Villar family napkin,

— Barok,

From the Kweba – where the truth still hasn’t been appraised at fair value.

Key Citations

A. Legal & Official Sources

- The Securities Regulation Code. Republic Act No. 8799, LawPhil Project, 23 July 2000.

- Code of Conduct and Ethical Standards for Public Officials and Employees. Republic Act No. 6713, LawPhil Project, 20 Feb. 1989.

B. News Reports

- ₱75 Million Heist: Cops Gone Full Bandit

- ₱6.7-Trillion Temptation: The Great Pork Zombie Revival and the “Collegial” Vote-Buying Circus

- ₱1.9 Billion for 382 Units and a Rooftop Pool: Poverty Solved, Next Problem Please

- ₱1.35 Trillion for Education: Bigger Budget, Same Old Thieves’ Banquet

- ₱1 Billion Congressional Seat? Sorry, Sold Out Na Raw — Si Bello Raw Ang Hindi Bumili

- “We Will Take Care of It”: Bersamin’s P52-Billion Love Letter to Corruption

- “Skewed Narrative”? More Like Skewered Taxpayers!

- “Scared to Sign Vouchers” Is Now Official GDP Policy – Welcome to the Philippines’ Permanent Paralysis Economy

- “Robbed by Restitution?” Curlee Discaya’s Tears Over Returning What He Never Earned

- “My Brother the President Is a Junkie”: A Marcos Family Reunion Special

- “Mapipilitan Akong Gawing Zero”: The Day Senator Rodante Marcoleta Confessed to Perjury on National Television and Thought We’d Clap for the Creativity

- “Bend the Law”? Cute. Marcoleta Just Bent the Constitution into a Pretzel

Leave a comment