By Louis ‘Barok’ C Biraogo — September 3, 2024

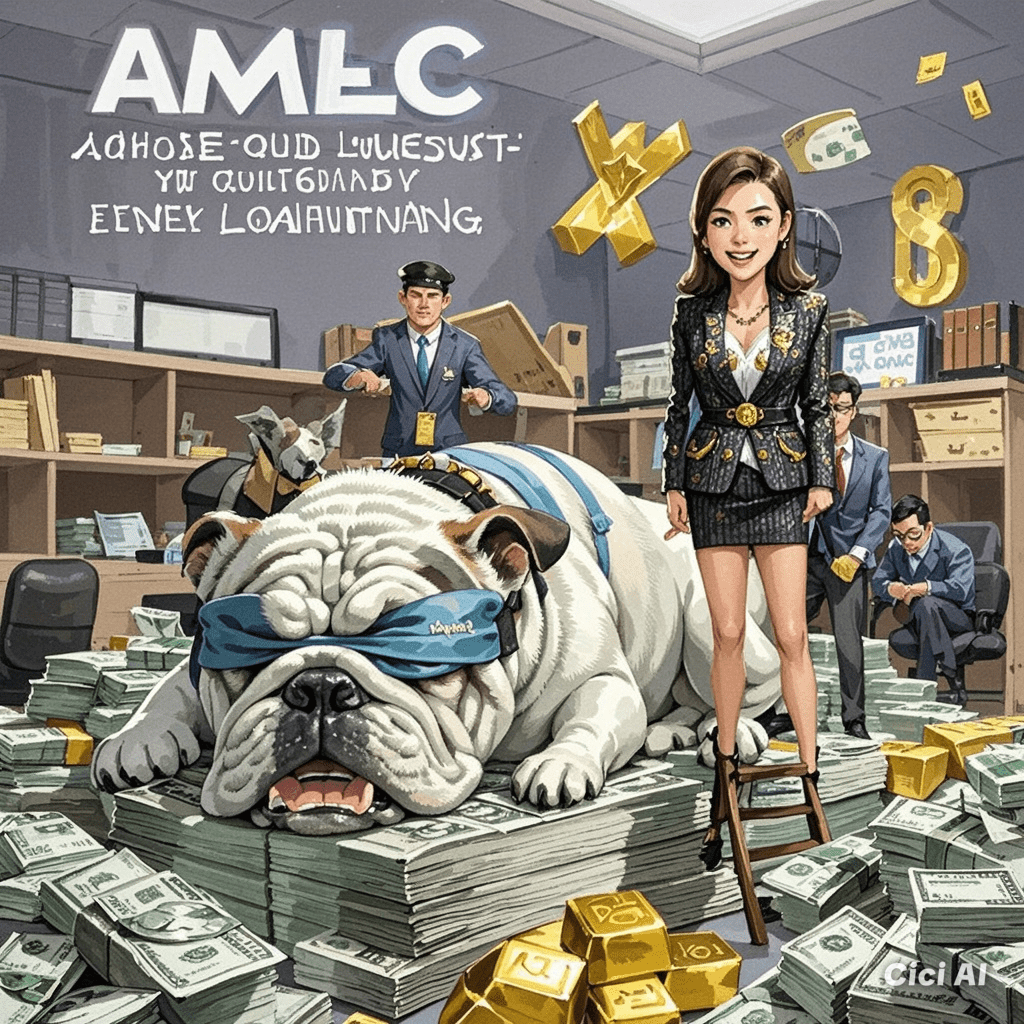

ONCE upon a time, in the bustling archipelago of the Philippines, an entity known as the Anti-Money Laundering Council (AMLC) was born. It was a time of optimism, where the powers that be believed in the noble cause of cleansing the nation’s financial system of dirty money. The AMLC was envisioned as the fearless watchdog, forever vigilant, sniffing out every peso that dared to tiptoe through the financial underworld. But, like all good fairy tales, the reality of AMLC’s journey turned out to be more of a cautionary tale, complete with a plot twist where the hero forgets to wake up for the climax.

You see, our dear AMLC began with the best of intentions. Armed with the Anti-Money Laundering Act of 2001, it was ready to pounce on any suspicious transaction over P500,000. And for a time, it did. It roared into action, barking at every banker and businessman who even thought of slipping a few extra zeros past its vigilant eyes. But somewhere along the way, our valiant watchdog got a little too cozy with the powers it was meant to keep in check. Maybe it was the late-night cups of coffee with politicians or the tempting aroma of power wafting through the corridors of its offices. Whatever the reason, the AMLC began to mellow. Instead of barking, it started to wag its tail at the very people it was supposed to be monitoring.

This brings us to the latest chapter in this ongoing saga: the curious case of former Bamban Mayor Alice Guo and her grand Pogo adventure. Now, if you’re unfamiliar with the world of Pogos (Philippine Offshore Gaming Operators), let me enlighten you. Pogos are the gold mines of the 21st century, where money flows like a river, and ethics are, well, optional. Mayor Guo, with her canny business acumen, decided to transform a quiet town in Tarlac into a sprawling Pogo hub, complete with all the glitz and glamour you’d expect from a multi-billion-peso venture.

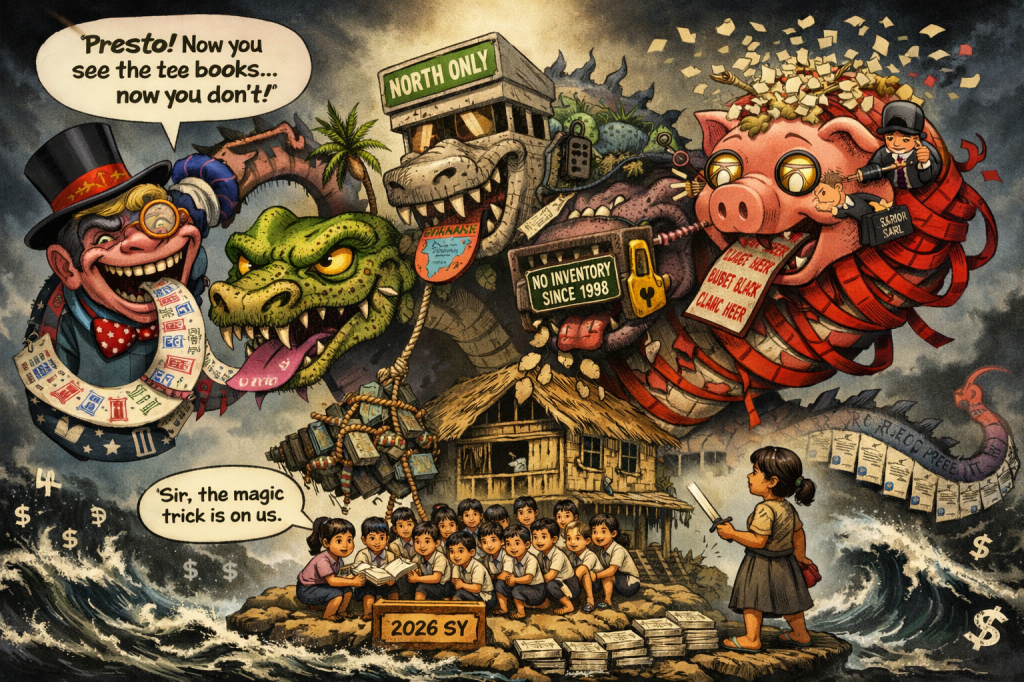

But wait, you ask, where did all this money come from? Surely, the AMLC, with its finely tuned radar for financial shenanigans, would have pounced on any questionable transactions, right? Well, here’s where our tale takes a humorous turn. It took our fearless AMLC a mere four years to notice that P7 billion was casually flowing through the veins of Bamban’s banking system, like a sugar rush at a children’s party. Yes, four years. That’s 48 months, 1,460 days, or roughly 35,040 hours, if you’re counting. It seems that, in the grand tradition of all bureaucracies, the AMLC believes in the adage, “Better late than never.”

Senator Sherwin Gatchalian, ever the vigilant critic, has now taken it upon himself to point out what should have been obvious to anyone with a calculator: the banks, much like the AMLC, were asleep at the wheel. According to the senator, these financial institutions had one job—report transactions over P500,000 that raised an eyebrow or two. But instead, they turned a blind eye, perhaps hoping that no one would notice the billions slipping through the cracks.

Now, in fairness to the banks, maybe they were just too busy counting their legitimate profits to worry about a few billion here and there. Or perhaps they figured that the AMLC, with its well-documented history of delayed reactions, would eventually catch on… someday. After all, who wouldn’t want to rely on an organization that has repeatedly proven its ability to act—eventually—when prompted by enough public outcry?

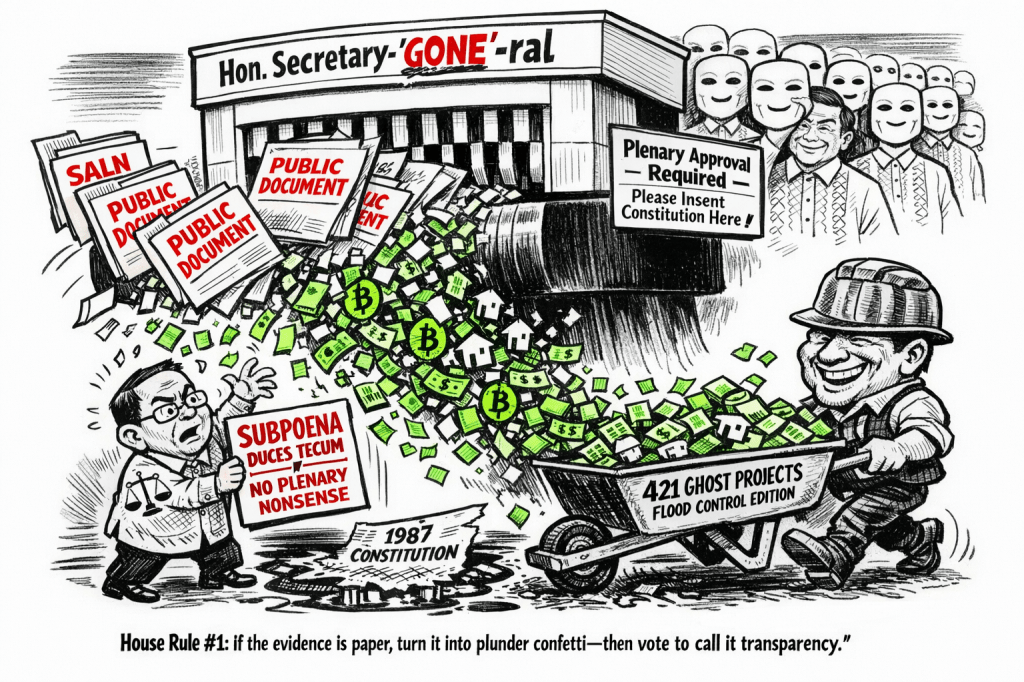

But let’s not be too harsh. The AMLC did eventually act, filing a string of cases against Guo and 35 others. And who can forget the grand estimate of P6 billion for the Pogo complex, an impressive figure indeed, especially when you consider that it only took four years for anyone to notice.

As for the AMLC’s response to Gatchalian’s criticisms? Well, they might argue that thorough investigations take time, and that the complex web of transnational crime doesn’t untangle itself overnight. They might point to the numerous cases they’ve successfully prosecuted (eventually) and emphasize that they’re still on the case, diligently working to ensure that no stone is left unturned—provided it’s not too heavy or inconvenient to move.

And what of the banks? Well, they might argue that they followed all the rules and that the suspicious transactions were just particularly good at hiding in plain sight. After all, with so much money flying around, who can keep track of every peso? Perhaps they’ll call for a review of the AMLC’s procedures, not to criticize, of course, but to “help” the council streamline its processes so that it might catch these things a little sooner next time—say, within a year or two.

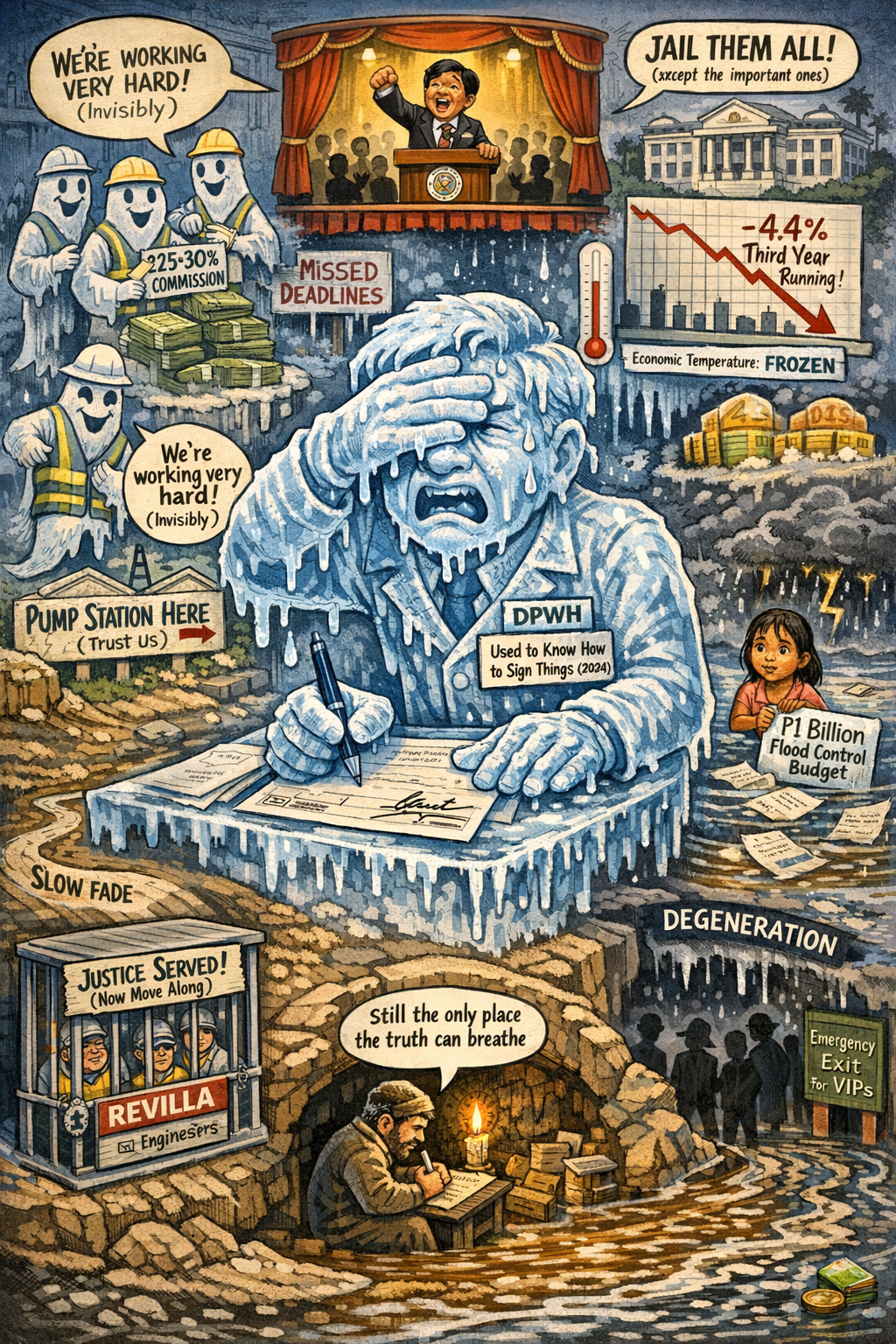

In the meantime, let’s offer some helpful advice to all parties involved:

To Senator Gatchalian: Consider organizing a national treasure hunt, with the AMLC as the main contestant. It might be the best way to keep them sharp.

To the AMLC: Perhaps it’s time to invest in some faster clocks or maybe a new calendar. Four years is a long time to wait for anyone, even for billions of pesos.

To the Banks: Maybe try counting with both eyes open next time. It might help.

And so, the saga of the AMLC continues, a never-ending tale of hope, disappointment, and a whole lot of wasted taxpayer money. But remember, even the most boring stories can have a surprising twist. So, stay tuned, folks. The AMLC might just surprise us all… or maybe they won’t.

Leave a comment